Table of Contents

PM Jandhan Overdraft Rs. 10,000 tak overdraft facility

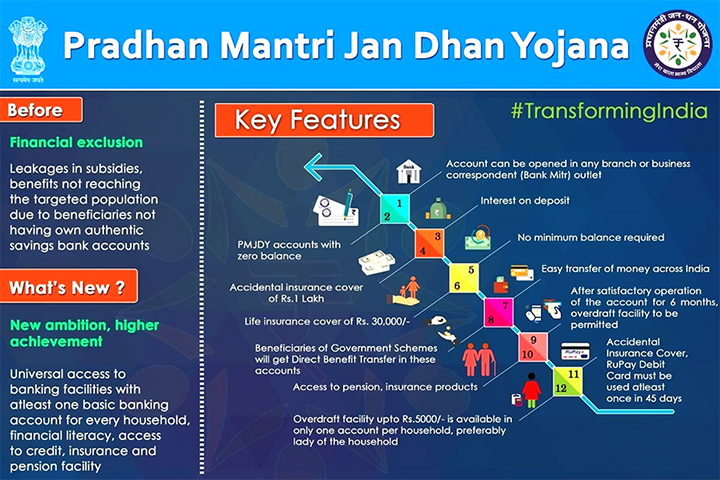

Pradhan Mantri Jan Dhan Yojana India ki sabse badi financial inclusion scheme hai jo poor aur disadvantaged families ko banking services se jodti hai। Is scheme ke under overdraft facility ke through account holders 10,000 rupees tak bina kisi guarantee ke withdraw kar sakte hain.

Pradhan Mantri Jan Dhan Yojana India ki sabse badi financial inclusion scheme hai jo poor aur disadvantaged families ko banking services se jodti hai। Is scheme ke under overdraft facility ke through account holders 10,000 rupees tak bina kisi guarantee ke withdraw kar sakte hain. aaj ham bat krenge ki aap PM Jan Dhan Overdraft Yojana Se Bina Aadhar Kaise Nikale Rs. 10000

Yeh scheme 28 August 2014 ko launch hui thi aur ab tak 56 crore se zyada accounts khule hain jisme 2.68 lakh crore rupees ki deposit hai। Scheme ne 11 saal successfully complete kiye hain August 2025 mein।

Zyada information ke liye hamara about us page visit kariye।

PM Jan Dhan Yojana Kya Hai

Pradhan Mantri Jan Dhan Yojana ko PM Narendra Modi ne 15 August 2014 ko Red Fort se announce kiya tha। Is scheme ka main purpose hai har Indian ko basic banking services provide karna। Yeh Guinness World Record bhi banaya hai jab ek week mein 1.8 crore accounts khule the

Scheme Ki Main Features:

Direct Benefit Transfer (DBT) ki facility

Zero balance account – koi minimum amount rakhne ki zarurat nahi

Free RuPay debit card – 2 lakh rupees accident insurance ke saath

10,000 rupees tak overdraft facility

Mobile banking ki facility

10,000 Rupees Overdraft Kaise Milta Hai

Overdraft ka matlab hai aap apne account mein paise na hone par bhi ek certain amount tak withdraw kar sakte hain। Yeh government ki taraf se loan ki facility hai jo bina guarantee ke milti hai

Overdraft yogyta kaise check kren?

Overdraft amount teen mein se jo sabse kam ho:

Average monthly balance ka 4 guna

Last 6 months mein aaye paise ka 50%

Hamare financial calculators se aap apni eligibility calculate kar sakte hain।

Overdraft Ke Liye Eligibility i.e. Required Conditions:

Family mein sirf ek member ko yeh facility milti hai (preference female ko)

Age 18 se 65 years ke beech honi chahiye

Account kam se kam 6 months se active hona chahiye

Account mein regular paise aane chahiye (DBT ya other source se)

Aadhaar card se account linked hona chahiye

Ineligible Persons:

Family mein ek se zyada member

Other bank mein account rakhne wale

10,000 Rupees Withdraw Karne Ka Process

Step 1: Documents Taiyar Kariye

Required documents:

Bina Aadhar Card ke PM Jan Dhan Overdraft A/c se Rs.10000 kaise nikale

Step 2: Bank Mein Application

- Bank branch jaiye jahan aapka account hai

- Overdraft form mangiye

- Form ko properly fill kariye

- Required documents attach kariye

- Bank officer ko submit kariye

Step 3: Approval Process

- Bank aapke account ka record dekhega

- Eligibility check hogi

- Approval ke baad amount account mein credit ho jayegi

Step 4: Paise Nikalna

Approval ke baad aap ye tarike se paise nikal sakte hain:

Business Correspondent ke through

ATM se withdraw kar sakte hain

Bank branch se withdraw kar sakte hain

POS machine se nikaal sakte hain

PM Jandhan Overdraft ke Interest Rate aur Charges

Zyada financial services ke liye hamaari services check kariye।

Repayment Terms

Duration:

Repayment:

Principal amount wapas karna hoga

Interest bhi dena hoga

PM Jandhan Overdraft ke laabh aur Nuksan

- Instant cash mil jaata hai – emergency mein helpful

- Koi guarantee nahi – bina security ke

- Kam paperwork – sirf basic documents

- Low interest rate – other personal loans se sasta

- Flexible repayment – 36 months tak ka time

- Women ko priority – empowerment ke liye

Financial Benefits:

- Emergency needs fulfill karna

- Small business ke liye capital

- Medical emergency mein helpful

- Education expenses ke liye useful

Main Disadvantages:

- Limited amount – sirf 10,000 rupees tak

- Interest payment – repayment mein extra amount

- 6 months waiting – new account mein turant nahi milti

- Family mein ek ko hi – sabko nahi

- Regular income zaroori – DBT ya other source chahiye

Additional Challenges:

- Account dormancy – 20% accounts inactive rehte hain

- Financial illiteracy – 65% Indians lack financial literacy

- Infrastructure issues – rural areas mein ATM/bank branch ki kami

- Multiple accounts – log duplicate accounts banate hain

- Misuse as mule accounts – money laundering ke liye use

Important Tips

Application Se Pehle:

- Account mein regular paise aana ensure kariye

- Aadhaar card ko account se link kariye

- 6 months ka wait kariye

- Sab documents ready rakhiye

Paise Withdraw Karne Ke Baad:

- Time pe repayment ka plan banayiye

- Interest calculation samjhiye

- Account ko active rakhiye

- Other bank account na kholiye

Hamare blog pe aur bhi useful information paayiye।

PM Jandhan Overdraft ke samay savdhaniyan

Common Mistakes:

PM Jandhan Overdraft me avoid Karne Wali Cheezein:

- Multiple banks mein ek saath application na kariye

- Family ke other members bhi application na kariye

- KYC incomplete na chhodiye

Digital Facilities

Online Services:

- Mobile banking se balance check

- Internet banking ki facility

- UPI payment ki facility

- Digital transactions mein growth

RuPay Card Benefits:

- 38.68 crore cards issue kiye gaye hain

- 2 lakh rupees accident insurance

- ATM aur POS pe use

- Cashless payment ki facility

Government Schemes Se Connection

Other Schemes Benefits:

- Pradhan Mantri Jeevan Jyoti Bima Yojana

- Pradhan Mantri Suraksha Bima Yojana

- Atal Pension Yojana

- MUDRA Yojana ka benefit

DBT Ka Importance:

Real Life Example

Practical Case:

Maan lijiye Ram ka Jan Dhan account hai aur last 6 months mein uske account mein average 2,500 rupees monthly aaye hain। To usse milne wali overdraft amount hogi:

- Average balance ka 4 guna: 2,500 × 4 = 10,000 rupees

- 6 months income ka 50%: 15,000 × 50% = 7,500 rupees

- Maximum limit: 10,000 rupees

Inmein se sabse kam 7,500 rupees Ram ko overdraft milega।

Kisi bhi question ke liye hum se contact kariye।

Challenges Aur Problems

Major Issues:

- Account inactivity – 20% accounts use nahi hote

- Duplication problem – log multiple accounts banate hain

- Infrastructure shortage – rural areas mein ATM/branch ki kami

- Financial illiteracy – 65% Indians ko financial knowledge nahi

- Technology barriers – poor internet connectivity

- Bank burden – banks ko maintain karna expensive

PM Jandhan Overdraft ke Fraud Aur Misuse:

- Money laundering ke liye use

- Business Correspondents ka misuse

- Fake accounts ka creation

- Over-indebtedness ka risk

Government Initiatives

Recent Campaigns:

Saturation Campaign (1 July 2025 – 30 September 2025):

- 2.7 lakh Gram Panchayats mein camps

- KYC update aur new accounts opening

- 1,77,102 camps already conducted

- Financial literacy promotion

Digital Growth:

- 2018-19: 2,338 crore transactions

- 2024-25: 22,198 crore transactions

- UPI transactions: 18,587 crore tak pahunche

Scheme Ka Development:

Government continuously improvements kar rahi hai। JAM Trinity (Jan-Dhan-Aadhaar-Mobile) ke through 6.9 lakh crore rupees transfer kiya gaya 2024-25 mein।

Expected Changes:

- Digital infrastructure improvement

- Financial literacy programs expansion

- Private sector participation increase

- Consumer protection framework strengthening

Conclusion

PM Jan Dhan Yojana ki overdraft facility poor aur middle-class families ke liye bohut helpful hai। 10,000 rupees tak ki yeh facility emergency mein bahut kaam aati hai। Although kuch limitations hain, lekin smartly use karne pe yeh bahut beneficial hoti hai।

Key Points:

- 6 months baad hi facility milti hai

- Family mein ek ko hi benefit

- Aadhaar card mandatory

- Time pe repayment necessary

Yeh scheme Atmanirbhar Bharat ke dream ko achieve karne mein important role play kar rahi hai।

Challenges exist karte hain jaise account dormancy aur financial illiteracy, lekin government continuous efforts kar rahi hai inhe solve karne ke liye