Toddler Healthcare Cost Inflation India 2025

Table of Contents

Healthcare cost inflation for toddlers in India has reached alarming levels, with medical expenses rising at 14% annually – nearly double the general inflation rate. This unprecedented surge in pediatric healthcare costs is creating significant financial pressure on Indian families, making it increasingly challenging to provide quality medical care for young children. Parents who budgeted for childcare expenses just a few years ago are now finding their estimates falling short as vaccination costs, consultation fees, and hospitalization expenses continue to climb. The situation is particularly dire for middle-class families who don’t qualify for government schemes but find private healthcare increasingly unaffordable.

Toddler healthcare cost inflation in India is outpacing general inflation, creating a financial crisis for many families struggling to balance quality care with affordability.

Child Medical Expenses Rising India Statistics

Recent data reveals shocking statistics about rising child medical expenses across India. The mean out-of-pocket expenditure for children in India stands at Rs 14,660, with infants under one year facing even higher expenses at Rs 21,564. These figures represent a 40-50% increase over the past five years, with no signs of slowing down. Medical inflation has consistently outpaced general inflation since 2020, making pediatric healthcare one of the fastest-growing expense categories for Indian families. The National Health Systems Resource Centre reports that healthcare expenses have increased by 14% annually since 2022, affecting everything from routine checkups to emergency treatments.

Child medical expenses in India are rising at an unsustainable rate, forcing many parents to make difficult choices between their child’s health and family finances.

Pediatric Healthcare Costs India Breakdown

Pediatric healthcare costs in India can be categorized into three main expense areas: OPD consultations, vaccinations, and hospitalization. Each category has seen significant price increases over recent years, with OPD consultations now costing ₹300-₹1,500 per visit, vaccinations ranging from ₹500-₹5,000 per dose, and hospitalization expenses ranging from ₹30,000-₹5,00,000 depending on the condition and facility. These costs vary significantly between metropolitan cities and smaller towns, with metro areas typically charging 40-60% more for identical services. The breakdown also reveals hidden costs that many parents overlook, including diagnostic tests, medications, follow-up consultations, and transportation to medical facilities.

Understanding the complete breakdown of pediatric healthcare costs in India is essential for parents to budget effectively and avoid financial surprises.

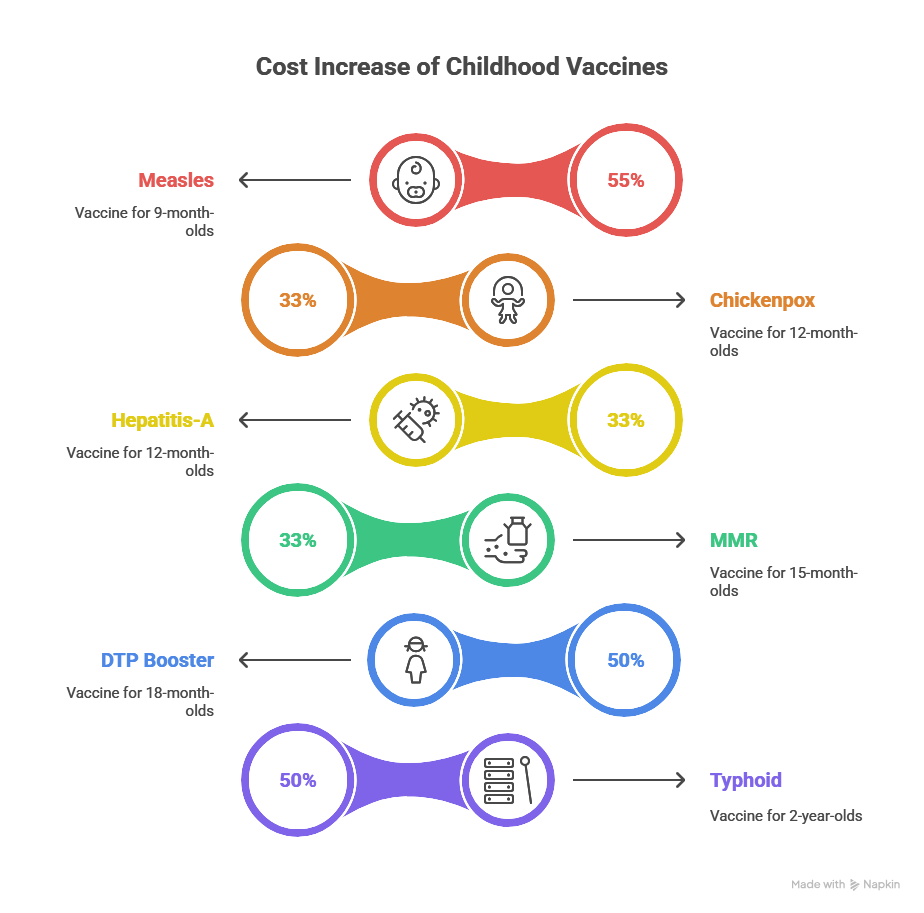

Toddler Vaccination Cost India Trends

Toddler vaccination costs in India have seen dramatic increases over the past five years, with most vaccines experiencing price hikes of 30-50%. Essential vaccines like measles (₹155-₹600), chickenpox (₹1,600 per dose), and hepatitis-A (₹1,000 per dose) have become significantly more expensive, creating a substantial financial burden for parents. While the Universal Immunization Program offers free essential vaccines, many newer and more effective vaccines are only available in private hospitals at full cost. A complete vaccination schedule up to age 5 can cost between ₹25,000-₹40,000 in private facilities, a sum that many middle-class families struggle to afford. The rising cost of toddler vaccinations in India is creating a dangerous gap where children from wealthier families receive better protection than those from economically disadvantaged backgrounds.

Toddler vaccination costs in India are rising faster than general inflation, making preventive healthcare increasingly inaccessible for many families.

Vaccination Cost Comparison: Then vs Now

| Age | Vaccine | Current Cost Range (₹) | Previous Cost (₹) | Cost Increase (%) |

|---|---|---|---|---|

| 9 Months | Measles | 155 – 600 | 100 – 400 | 55% |

| 12 Months | Chickenpox | 1,600 per dose | 1,200 per dose | 33% |

| 12 Months | Hepatitis-A | 1,000 per dose | 750 per dose | 33% |

| 15 Months | MMR | 600 – 850 | 450 – 650 | 33% |

| 18 Months | DTP Booster | 300 – 600 | 200 – 400 | 50% |

| 2 Years | Typhoid | 1,500 – 2,000 | 1,000 – 1,500 | 50% |

The table above clearly illustrates the significant increase in vaccination costs over recent years, with most vaccines seeing price hikes of 30-50%. This trend is particularly concerning as vaccinations are essential for preventing serious diseases and cannot be skipped without putting the child’s health at risk.

The rising cost of toddler vaccinations in India is creating a financial barrier to essential preventive healthcare for many families.

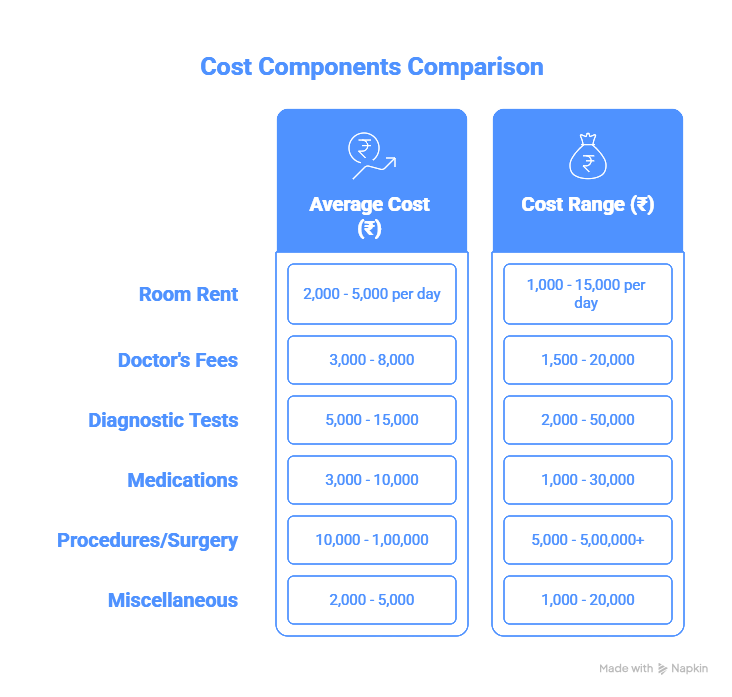

Child Hospitalization Cost India Analysis

Child hospitalization costs in India represent the most significant financial risk for parents, with expenses ranging from ₹30,000-₹5,00,000 or more depending on the condition and treatment required. Common reasons for toddler hospitalization include respiratory infections, gastrointestinal issues, accidents, and planned surgeries. These costs have been increasing at 10-15% annually, far outpacing wage growth and inflation. The financial impact is particularly severe for families without adequate health insurance, often forcing them to borrow money, sell assets, or compromise on treatment quality. The disparity between government and private hospital costs is stark, with government facilities offering treatments at 50-70% lower costs but often with longer wait times and limited amenities.

Child hospitalization costs in India can be financially catastrophic for unprepared families, highlighting the critical need for comprehensive health insurance coverage.

Toddler Hospitalization Cost Breakdown

| Cost Component | Average Cost (₹) | Range (₹) |

|---|---|---|

| Room Rent | 2,000 – 5,000 per day | 1,000 – 15,000 per day |

| Doctor’s Fees | 3,000 – 8,000 | 1,500 – 20,000 |

| Diagnostic Tests | 5,000 – 15,000 | 2,000 – 50,000 |

| Medications | 3,000 – 10,000 | 1,000 – 30,000 |

| Procedures/Surgery | 10,000 – 1,00,000 | 5,000 – 5,00,000+ |

| Miscellaneous | 2,000 – 5,000 | 1,000 – 20,000 |

For a 3-day hospitalization for a common condition like pneumonia, parents can expect to pay between ₹25,000-₹50,000 in a private hospital in a tier-1 city. For more complex conditions or longer stays, this amount can easily exceed ₹1,00,000. These costs have been rising at an alarming rate, with hospitalization costs increasing by 10.1% in rural areas and 10.7% in urban areas between 2004 and 2014.

The rising cost of pediatric hospitalization in India is pushing many families into financial distress, with some even having to borrow money or sell assets to cover medical bills.

Health Insurance for Toddlers India Guide

Health insurance for toddlers in India has become an essential financial tool for parents seeking to protect their children from rising medical costs. The Indian health insurance industry is growing at 12.8% CAGR, with specialized child health plans becoming increasingly popular. These plans typically cover hospitalization, surgeries, and sometimes OPD treatments and vaccinations, providing crucial financial protection during medical emergencies. However, choosing the right health insurance for toddlers requires careful consideration of coverage limits, exclusions, network hospitals, and premium costs. Many parents are now realizing that basic health insurance may not be sufficient given the rapid rise in healthcare costs, leading them to seek more comprehensive coverage options.

Health insurance for toddlers in India is no longer a luxury but a necessity for parents seeking to protect their children from the financial burden of rising healthcare costs.

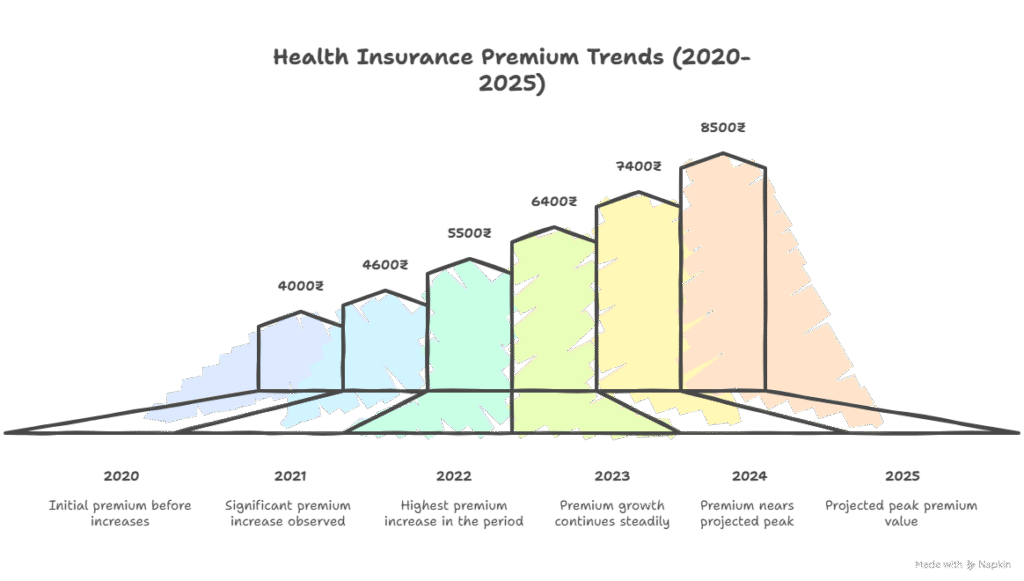

Child Health Insurance Premium India Trends

Child health insurance premiums in India have been increasing at alarming rates, with retail premiums rising by 16.5% in 2022 alone. This trend has continued, with many policyholders facing annual premium increases of 15-20%. The average annual premium for child health insurance has risen from ₹4,000 in 2020 to ₹7,400 in 2024, with projections reaching ₹8,500 by 2025. These premium increases are directly linked to medical inflation, which currently stands at 14% annually. For families on tight budgets, these rising premiums are creating a difficult dilemma: maintain coverage at increasingly unaffordable rates or risk going without insurance and facing potentially catastrophic medical bills.

Child health insurance premiums in India are rising faster than most families can afford, creating a protection gap that leaves many toddlers vulnerable to financial hardship during medical emergencies.

Health Insurance Premium Trends Over Time

| Year | Average Annual Premium (₹) | Premium Increase (%) | Medical Inflation Rate (%) |

|---|---|---|---|

| 2020 | 4,000 | – | 10% |

| 2021 | 4,600 | 15% | 12% |

| 2022 | 5,500 | 19.5% | 14% |

| 2023 | 6,400 | 16.5% | 14% |

| 2024 | 7,400 | 15.6% | 14% |

| 2025 (Projected) | 8,500 | 14.9% | 13% |

The table clearly shows that health insurance premiums for children have been increasing at rates higher than medical inflation, making insurance coverage more expensive each year. This trend is particularly concerning for families who purchased policies years ago at lower rates and now face steep increases upon renewal.

The escalating cost of child health insurance premiums in India is creating a protection gap that leaves many toddlers vulnerable to financial hardship during medical emergencies.

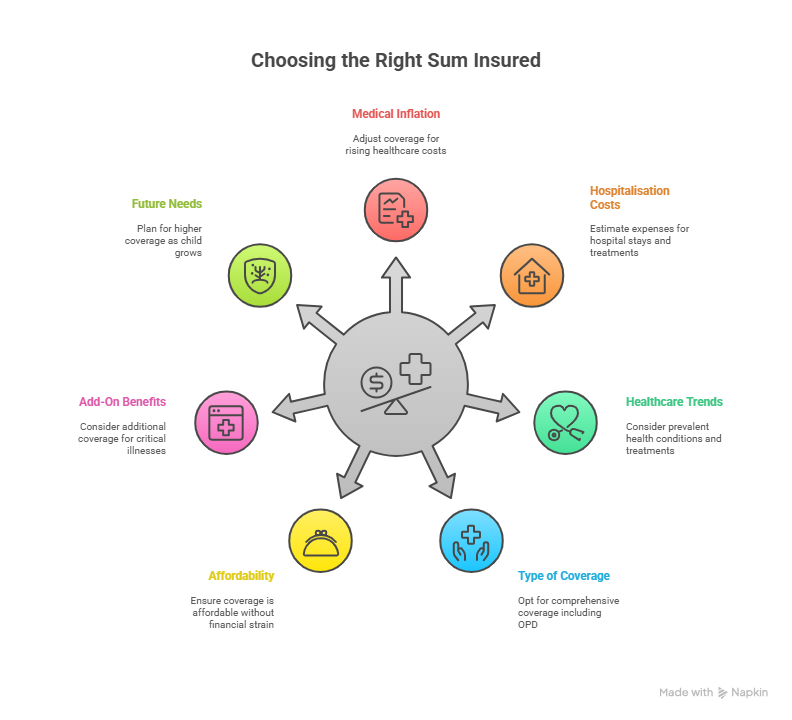

Sum Insured for Child Health Insurance India, Recommendations

Financial experts recommend a sum insured of ₹5L-₹10L for child health insurance in India, considering current healthcare costs and medical inflation trends. This range provides adequate coverage for most pediatric medical expenses while accounting for future cost increases. When determining the right sum insured, parents should consider factors like their location (metro cities require higher coverage), preferred healthcare facilities (private hospitals need higher sum insured), and any pre-existing conditions their child may have. It’s also important to account for medical inflation when selecting coverage, as healthcare costs are expected to continue rising at 12-14% annually. Many parents make the mistake of choosing lower sum insured to reduce premiums, only to find themselves with inadequate coverage when faced with major medical expenses.

Choosing the right sum insured for child health insurance in India is crucial for ensuring adequate financial protection against the relentless rise in healthcare costs.

Factors to Consider When Choosing Sum Insured

| Factor | Explanation | Recommendation |

|---|---|---|

| Medical Inflation | Account for rising healthcare costs over time | Add 14% annually to current cost estimates |

| Hospitalisation Costs | Estimate expenses for hospital stays, surgeries, and treatments | Budget ₹50,000-₹1,00,000 for a 3-5 day stay |

| Healthcare Trends | Consider prevalent health conditions and treatments | Include coverage for common toddler illnesses |

| Type of Coverage | Different plans cover various aspects of healthcare | Opt for comprehensive coverage including OPD |

| Affordability | Coverage should be affordable without straining finances | Premium should not exceed 5% of monthly income |

| Add-On Benefits | Additional coverage might require a higher sum insured | Consider riders for critical illnesses |

| Future Needs | Anticipate future medical requirements | Plan for higher coverage as child grows |

It’s important to remember that healthcare costs vary significantly based on your location, with metropolitan cities generally having higher medical expenses than smaller towns and rural areas. For instance, a hospitalization that costs ₹50,000 in a tier-2 city might cost ₹1,00,000 or more in Mumbai or Delhi. Therefore, parents living in metro areas should consider higher sum insured amounts to account for these regional cost differences.

Geographical location plays a crucial role in determining the right sum insured for your toddler’s health insurance, with metro cities requiring higher coverage due to increased medical costs.

Government Healthcare Schemes for Children India Overview

Government healthcare schemes for children in India provide crucial support for families who cannot afford private healthcare. The most comprehensive is Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY), offering health coverage of up to ₹5 lakh per family per year for hospitalization. The Universal Immunization Program (UIP) provides free essential vaccinations for all children, while Rashtriya Bal Swasthya Karyakram (RBSK) offers early screening and intervention services. Additionally, many states have their own child health schemes, such as the Mukhyamantri Bal Hriday Suraksha Yojana in Uttar Pradesh. These government initiatives play a vital role in ensuring that even economically disadvantaged children have access to essential healthcare services. However, awareness about these schemes remains low, and many eligible families fail to take advantage of the available benefits.

Government healthcare schemes for children in India are a lifeline for economically disadvantaged families, but more needs to be done to increase awareness and accessibility.

Toddler Healthcare Planning India Strategies

Effective toddler healthcare planning in India requires a multi-faceted approach that combines insurance coverage, emergency funds, and preventive care. Parents should start by building a dedicated health emergency fund equivalent to 3-6 months of living expenses, with a portion specifically earmarked for medical costs. This fund should be separate from general savings and easily accessible during emergencies. Next, investing in comprehensive health insurance with adequate sum insured provides crucial financial protection for major medical expenses. Additionally, maintaining a separate budget for routine healthcare costs like vaccinations and checkups helps avoid financial strain. Regular reviews of healthcare expenses and insurance coverage ensure that planning remains relevant as the child grows and healthcare costs continue to rise.

Strategic toddler healthcare planning in India is essential for parents seeking to provide quality medical care without compromising their family’s financial stability.

Child Medical Emergency Fund India Importance

A child medical emergency fund is an essential financial tool for Indian parents, providing a safety net during unexpected healthcare crises. This fund should ideally contain 3-6 months of living expenses, with a significant portion allocated specifically for medical costs. Having this financial cushion can help parents cover unexpected medical expenses without disrupting their regular budget or resorting to high-interest loans. For toddlers, who are more susceptible to sudden illnesses and accidents, this emergency fund is particularly crucial. Medical emergencies can arise without warning, and having immediate access to funds can make the difference between timely treatment and dangerous delays. Many financial advisors recommend keeping this fund in a separate, easily accessible account that can be accessed quickly during emergencies.

A dedicated child medical emergency fund is one of the most important financial preparations parents can make to ensure their toddler receives prompt medical care when needed.

Pediatric OPD Costs India Analysis

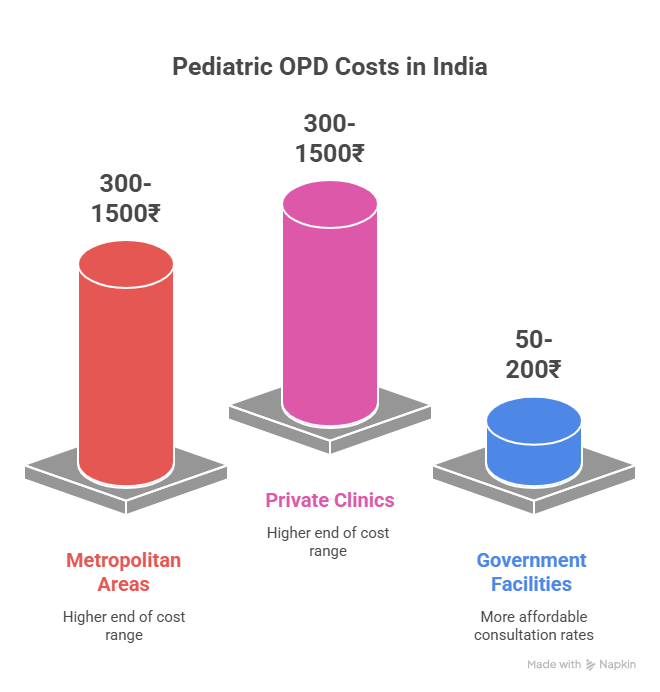

Pediatric OPD costs in India have been rising steadily, with consultation fees now ranging from ₹300-₹1,500 per visit depending on the city and doctor’s experience. In metropolitan areas, parents typically pay at the higher end of this range, while tier-2 and tier-3 cities offer more affordable rates. These costs represent a 30-40% increase over the past five years, making regular pediatric visits a significant expense for many families. A typical toddler may require 4-6 routine checkups annually, plus additional visits for common childhood illnesses, resulting in annual OPD expenses of ₹10,000-₹15,000 in urban areas. The disparity between government and private OPD costs is substantial, with government facilities charging ₹50-₹200 per consultation compared to ₹300-₹1,500 in private clinics.

Pediatric OPD costs in India are creating a recurring financial burden for parents, making regular medical checkups increasingly difficult to afford for many families.

Child Health Insurance Comparison India Options

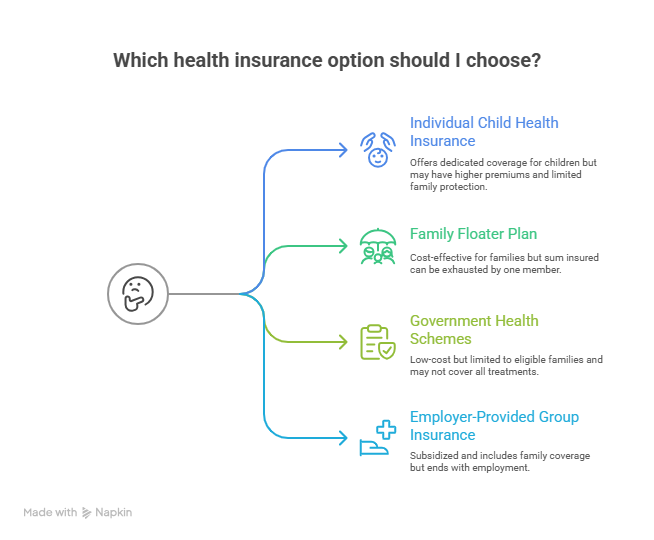

When comparing child health insurance options in India, parents typically consider four main types: individual child health insurance, family floater plans, government health schemes, and employer-provided group insurance. Individual child policies offer dedicated coverage but come at higher premiums, while family floater plans provide cost-effective coverage for the entire family but with shared sum insured limits. Government schemes like Ayushman Bharat offer free or subsidized coverage for eligible families, while employer-provided group insurance often includes family coverage at subsidized rates. Each option has its pros and cons, and the best choice depends on factors like family size, budget, healthcare needs, and employment status. Many families find that a combination of options works best, such as using government schemes for basic care and private insurance for comprehensive coverage.

Child health insurance comparison in India reveals no one-size-fits-all solution, with each family needing to evaluate their unique circumstances and healthcare requirements.

Pros and Cons of Different Health Insurance Options

| Insurance Type | Pros | Cons |

|---|---|---|

| Individual Child Health Insurance | – Dedicated coverage for child – No risk of sum insured exhaustion by other family members – Can be tailored to child’s specific needs | – Higher premium compared to family plans – Limited to child’s coverage only – May not offer comprehensive family protection |

| Family Floater Plan | – Cost-effective for entire family – Single premium for all members – Higher sum insured shared among family | – Sum insured can be exhausted by one member’s illness – May not provide adequate coverage if multiple members fall ill – Premium increases with family size |

| Government Health Schemes (Ayushman Bharat) | – Low or no cost for eligible families – Covers hospitalization expenses – Wide network of empaneled hospitals | – Limited to families below poverty line – May not cover all treatments – Quality of care can vary |

| Employer-Provided Group Insurance | – Often subsidized by employer – Usually includes family coverage – No medical check-ups required | – Coverage ends when employment ends – May have limited sum insured – Customization options are limited |

Individual child health insurance plans offer dedicated coverage specifically designed for pediatric healthcare needs. These plans often include benefits like vaccination coverage, pediatric consultations, and child-specific treatments that might not be available in standard health insurance policies. However, they come at a higher premium compared to family plans, and the coverage is limited to the child only, which might not be the most cost-effective option for families with multiple children or those looking for comprehensive family protection.

Individual child health insurance plans offer specialized coverage for toddlers but at a higher cost, making them suitable for families seeking dedicated pediatric protection.

Toddler Healthcare Cost Saving Tips India

Saving on toddler healthcare costs in India requires smart strategies that don’t compromise on quality of care. One effective approach is to leverage government healthcare facilities for routine services like vaccinations and basic checkups, while using private hospitals only for specialized treatments or emergencies. Another cost-saving tip is to ask doctors for generic medications, which can cost 30-70% less than branded drugs while offering the same benefits. Parents should also compare prices at different pharmacies and diagnostic centers, as costs can vary significantly. Maintaining organized medical records helps avoid duplicate tests and unnecessary consultations, further reducing expenses. Additionally, focusing on preventive healthcare through proper nutrition, hygiene, and timely vaccinations can prevent many common childhood illnesses, reducing the need for expensive treatments later.

Implementing smart cost-saving strategies for toddler healthcare in India can help parents provide quality medical care while maintaining financial stability.

Child Medical Calculator India Benefits

The Child Medical Calculator available at https://ourfinocracy.com/child-medical-calculator/ is an invaluable tool for Indian parents seeking to plan their toddler’s healthcare expenses. This innovative calculator helps estimate costs based on factors like the child’s condition, age, gender, preferred healthcare facility, and estimated duration of treatment. By providing cost estimates for different scenarios, it enables parents to budget effectively and make informed decisions about where to seek treatment. The calculator also highlights the significant cost differences between government and private healthcare facilities, helping parents choose the most appropriate option based on their budget and healthcare needs. Regular use of this tool can help families build comprehensive healthcare budgets and avoid financial surprises during medical emergencies.

The Child Medical Calculator in India is empowering parents with the information they need to plan and budget for their toddler’s healthcare expenses in an era of rising medical costs.

Ayushman Bharat for Children India Coverage

Ayushman Bharat for children in India provides comprehensive health coverage under the world’s largest government-funded healthcare program. This scheme offers health coverage of up to ₹5 lakh per family per year for secondary and tertiary care hospitalization, benefiting millions of children across the country. The program covers a wide range of pediatric treatments and surgeries, including those for congenital diseases, cancer, and other serious conditions. One of the key advantages of Ayushman Bharat is its cashless treatment feature at empaneled hospitals, eliminating the need for families to arrange funds during medical emergencies. However, awareness about the scheme remains low, and many eligible families fail to enroll or utilize the benefits available to them. The scheme has been particularly beneficial for families below the poverty line, ensuring that their children receive necessary medical care without causing financial hardship.

Ayushman Bharat for children in India is transforming access to healthcare for economically disadvantaged families, but more needs to be done to increase awareness and enrollment.

Family Floater vs Individual Child Insurance India Comparison

The choice between family floater and individual child insurance in India depends on various factors including family size, budget, and healthcare needs. Family floater plans typically cost 20-30% less than individual policies and offer coverage for the entire family under a single sum insured. However, the shared coverage can be a limitation if multiple family members require expensive treatments in the same year. Individual child policies provide dedicated coverage that won’t be affected by other family members’ medical needs but come at a higher premium. For most families with one or two children, a family floater plan with adequate sum insured (₹10L-₹15L) offers the best balance of cost and coverage. However, families with children who have chronic health conditions may benefit from individual policies to ensure dedicated coverage.

The decision between family floater and individual child insurance in India requires careful consideration of family healthcare needs and financial constraints.

Toddler Healthcare Budget India Planning

Creating a comprehensive toddler healthcare budget in India requires accounting for both routine and unexpected medical expenses. Parents should allocate funds for regular pediatric consultations (₹3,000-₹6,000 annually), vaccinations (₹5,000-₹10,000 annually for private facilities), and potential minor treatments (₹7,000-₹14,000 annually). Additionally, setting aside money for a health emergency fund is crucial for covering unexpected hospitalization costs that can range from ₹30,000-₹5,00,000 or more. Financial advisors recommend that healthcare expenses should not exceed 10-15% of the family’s monthly income, though this may vary based on individual circumstances. Regular reviews and adjustments to the healthcare budget are essential to account for medical inflation and changing healthcare needs as the child grows.

A well-planned toddler healthcare budget in India helps parents provide quality medical care while maintaining financial stability and avoiding debt during medical emergencies.

Child Healthcare Inflation Rate India Impact

The child healthcare inflation rate in India, currently standing at 14%, has a profound impact on family finances and healthcare access. This rate is significantly higher than general inflation, meaning that healthcare costs are consuming an increasingly larger portion of household budgets. For families with young children, who require frequent medical attention, this inflation rate translates to substantial increases in annual healthcare expenses. The impact is particularly severe for middle-class families who don’t qualify for government assistance but find private healthcare increasingly unaffordable. Over a five-year period, healthcare costs can nearly double due to this high inflation rate, making long-term financial planning extremely challenging. Many families are forced to make difficult choices between their child’s healthcare needs and other essential expenses like education and housing.

The child healthcare inflation rate in India is creating a financial crisis for many families, threatening their ability to provide quality medical care for their children.

Pediatric Healthcare Cost Management India Strategies

Effective pediatric healthcare cost management in India requires a proactive approach that combines preventive care, smart insurance choices, and financial planning. Parents should prioritize preventive healthcare through regular checkups, timely vaccinations, and healthy lifestyle choices to avoid costly treatments later. Choosing the right health insurance with adequate sum insured is crucial for financial protection against major medical expenses. Additionally, maintaining a separate health emergency fund provides a safety net for unexpected medical costs. Comparing prices at different healthcare facilities and pharmacies can help reduce routine healthcare expenses, while leveraging government schemes can provide substantial savings for eligible families. Regular reviews of healthcare expenses and insurance coverage ensure that cost management strategies remain effective as the child grows and healthcare costs continue to rise.

Strategic pediatric healthcare cost management in India is essential for parents seeking to provide quality medical care while maintaining financial stability in the face of rising healthcare costs.

Future of Toddler Healthcare Costs India Outlook

The future of toddler healthcare costs in India points to continued increases, with medical inflation expected to remain at 12-14% annually for the foreseeable future. Several factors will contribute to this trend, including the increasing prevalence of chronic diseases among children, growing demand for quality healthcare services, and the introduction of newer, more expensive medical technologies and treatments. The health insurance industry is expected to respond with more innovative products designed specifically for pediatric healthcare, though premiums are likely to continue rising as well. Government initiatives will play a crucial role in determining whether healthcare remains accessible to all children or becomes increasingly divided along economic lines. For parents, this outlook underscores the importance of early and proactive financial planning for their toddler’s healthcare needs, including comprehensive insurance coverage and dedicated health emergency funds.

The future of toddler healthcare costs in India presents significant challenges for parents, making financial planning and preventive healthcare more important than ever.

What is the average annual healthcare cost for a toddler in India?

The average annual healthcare cost for a toddler in India varies significantly based on location, healthcare facility choice, and the child’s health needs. On average, parents can expect to spend between ₹15,000-₹30,000 annually on routine healthcare, including vaccinations (₹5,000-₹10,000), pediatric consultations (₹3,000-₹6,000), and minor treatments (₹7,000-₹14,000). However, this amount can increase substantially if the child requires hospitalization or specialized treatments, which can cost anywhere from ₹30,000-₹5,00,000 or more per incident. These costs have been rising at approximately 14% annually due to medical inflation, making financial planning increasingly important for parents.

“The average annual healthcare cost for toddlers in India is rising at an alarming rate, forcing parents to allocate more of their budget to medical expenses each year.”

How does medical inflation specifically affect toddler healthcare costs?

Medical inflation in India, currently at 14%, affects toddler healthcare costs more severely than general inflation because pediatric care involves frequent medical interactions. Vaccination costs have increased by 30-50% over the past five years, pediatric consultation fees have risen by 25-40%, and hospitalization costs for children have increased by 10-15% annually. This means that the healthcare expenses you budget for your toddler today could be significantly higher by next year. Medical inflation impacts all aspects of toddler healthcare, from routine checkups to emergency treatments, making it essential for parents to account for these increases when planning their healthcare budget.

“Medical inflation for toddler healthcare in India outpaces general inflation, creating a growing financial burden for parents across the country.”

Are government hospitals a viable option for toddler healthcare in India?

Government hospitals can be a viable option for toddler healthcare in India, especially for routine services like vaccinations and basic treatments. These facilities offer services at minimal or no cost under various government schemes, including the Universal Immunization Program, which provides essential vaccines free of charge. However, government hospitals often face challenges like overcrowding, longer wait times, limited availability of specialists, and sometimes outdated equipment. For routine preventive care and minor illnesses, government hospitals can provide quality care at a fraction of private hospital costs. For specialized treatments or emergencies, private hospitals might be preferable despite the higher costs.

“Government hospitals in India offer affordable toddler healthcare options but come with limitations in terms of wait times and specialized services.”

What should be the ideal sum insured for my toddler’s health insurance?

The ideal sum insured for your toddler’s health insurance in India should be between ₹5L-₹10L, considering current healthcare costs and medical inflation trends. This range provides adequate coverage for most pediatric medical expenses, including hospitalization, surgeries, and treatments. When determining the exact amount, consider factors like your location (metro cities require higher coverage), preferred healthcare facilities (private hospitals need higher sum insured), and any pre-existing conditions your child may have. It’s also wise to account for future cost increases due to medical inflation, so choosing a slightly higher sum insured today can prevent inadequate coverage in the future.

“Selecting the right sum insured for your toddler’s health insurance is crucial for ensuring adequate financial protection against rising healthcare costs in India.”

How can I reduce vaccination costs for my toddler without compromising on quality?

You can reduce vaccination costs for your toddler without compromising on quality by utilizing government healthcare facilities that offer essential vaccines free under the Universal Immunization Program. For vaccines not covered in the government program, compare prices at different private hospitals and clinics, as costs can vary significantly. Some hospitals offer vaccination packages at discounted rates when multiple vaccines are administered together. Additionally, check if your health insurance plan covers vaccinations, as some comprehensive policies include this benefit. Timing vaccinations during special health camps or government initiatives can also provide access to free or subsidized vaccines.

“Strategic vaccination planning can help parents significantly reduce toddler healthcare costs without compromising on the quality of preventive care.”

What are the common hidden costs in toddler healthcare that parents often overlook?

Parents often overlook several hidden costs in toddler healthcare that can significantly impact their budget. These include diagnostic tests and blood work (₹500-₹3,000 per test), medications and prescriptions (₹200-₹2,000 per course), follow-up consultations (₹300-₹1,500 per visit), transportation to and from medical facilities (₹200-₹1,000 per visit), and indirect costs like parental time off work for medical appointments. Additional hidden costs may include special dietary requirements during illness, medical equipment like nebulizers or thermometers, and emergency room visits outside regular hours. Being aware of these potential expenses can help parents plan more comprehensively for their toddler’s healthcare needs.

“Hidden healthcare costs for toddlers in India can add up quickly, creating unexpected financial burdens for unprepared parents.”

How do I choose between a family floater plan and an individual policy for my toddler?

Choosing between a family floater plan and an individual policy for your toddler depends on your family’s specific needs and financial situation. Family floater plans are generally more cost-effective, offering coverage for the entire family under a single premium that’s 20-30% less than separate individual policies. However, the sum insured is shared among all family members, which could be a limitation if multiple members require expensive treatments in the same year. Individual policies for your toddler provide dedicated coverage that won’t be affected by other family members’ medical needs, but they come at a higher cost. For most families with one or two children, a family floater plan with adequate sum insured (₹10L-₹15L) offers the best balance of cost and coverage.

“The choice between family floater and individual health insurance for toddlers in India depends on family size, health needs, and budget constraints.”

What are the most common reasons for toddler hospitalization in India and their typical costs?

The most common reasons for toddler hospitalization in India include respiratory infections (pneumonia, bronchiolitis), gastrointestinal infections (diarrhea, vomiting), febrile seizures, accidents and injuries, and planned surgeries like tonsillectomy or hernia repair. The typical costs for these hospitalizations vary based on severity and facility type: respiratory infections (₹25,000-₹60,000 for 3-5 days), gastrointestinal issues (₹20,000-₹50,000 for 2-4 days), febrile seizures (₹15,000-₹40,000 for 1-3 days), accident-related injuries (₹30,000-₹1,00,000+ depending on severity), and planned surgeries (₹40,000-₹1,50,000). These costs have been increasing annually due to medical inflation, making health insurance essential for financial protection.

“Common toddler hospitalizations in India can cost families anywhere from ₹15,000 to ₹1,50,000, depending on the condition and treatment facility.”

How can I prepare financially for unexpected toddler medical emergencies?

Preparing financially for unexpected toddler medical emergencies involves several proactive steps. First, build a dedicated health emergency fund equivalent to 3-6 months of living expenses, with a portion specifically earmarked for medical costs. Second, invest in comprehensive health insurance with adequate sum insured (₹5L-₹10L) that covers hospitalization, OPD treatments, and emergency care. Third, maintain a separate fund for routine healthcare expenses like vaccinations and checkups. Fourth, keep digital and physical copies of all medical records and insurance documents easily accessible. Fifth, research and identify network hospitals near your home for cashless treatment options. Finally, consider additional coverage through critical illness riders or accident protection policies for enhanced financial security.

“Financial preparation for toddler medical emergencies in India requires a multi-faceted approach including emergency funds, comprehensive insurance, and organized medical records.”

Are there any government schemes that can help with toddler healthcare costs in India?

Yes, several government schemes in India can help with toddler healthcare costs. The most comprehensive is Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY), which provides health coverage of up to ₹5 lakh per family per year for secondary and tertiary care hospitalization. The Universal Immunization Program (UIP) offers free vaccinations for all children against various diseases. Rashtriya Bal Swasthya Karyakram (RBSK) provides early screening and intervention services for children from birth to 18 years. Additionally, many states have their own health schemes for children, such as the Mukhyamantri Bal Hriday Suraksha Yojana in Uttar Pradesh and the Bala Hakkula Pathakam in Telangana. Eligibility and benefits vary by scheme, so parents should research the options available in their state.

“Government healthcare schemes in India provide crucial financial support for toddler healthcare costs, but many eligible families fail to utilize these benefits due to lack of awareness.”

How often should I review and update my toddler’s health insurance coverage?

You should review and update your toddler’s health insurance coverage at least once every year, preferably during the renewal period. Annual reviews allow you to assess whether the current sum insured is still adequate given the 14% medical inflation rate and your child’s changing healthcare needs. Additionally, review your coverage after any significant life events, such as moving to a new city (which may affect healthcare costs), changes in family income, or if your child develops a new health condition. During these reviews, consider whether you need to increase the sum insured, add any riders or additional benefits, or switch to a different plan that better meets your child’s current healthcare needs. Regular reviews ensure that your toddler always has adequate financial protection against rising healthcare costs.

“Annual reviews of toddler health insurance coverage in India are essential to ensure adequate protection against rising healthcare costs and changing medical needs.”

What are the key differences between toddler healthcare costs in metro cities versus smaller towns in India?

Toddler healthcare costs in metro cities are typically 40-60% higher than in smaller towns in India. In metropolitan areas like Mumbai, Delhi, and Bangalore, pediatric consultations cost ₹800-₹1,500 per visit compared to ₹300-₹800 in smaller towns. Vaccination costs in metros are 30-50% higher, with the same vaccine costing ₹1,000-₹2,000 more in private hospitals. Hospitalization costs show the most significant difference, with a 3-day stay for a common condition like pneumonia costing ₹40,000-₹70,000 in metros versus ₹25,000-₹40,000 in smaller towns. These differences are attributed to higher operational costs, real estate prices, and salaries for medical professionals in metropolitan areas. However, metro cities also offer more specialized healthcare facilities and advanced treatment options that may not be available in smaller towns.

“The cost disparity between metro cities and smaller towns for toddler healthcare in India is significant, with metropolitan areas charging 40-60% more for identical medical services.”

How can I use the Child Medical Calculator effectively for my toddler’s healthcare planning?

You can use the Child Medical Calculator effectively for your toddler’s healthcare planning by inputting accurate information about your child’s specific health needs and preferences. Start by selecting your toddler’s condition from the dropdown menu, whether it’s a common viral fever, scheduled vaccination, or potential hospitalization scenario. Enter your child’s gender and age, as these factors can influence treatment approaches and costs. Choose between government and private healthcare facilities based on your preference and budget, keeping in mind that government hospitals typically cost 50-70% less. Estimate the duration of treatment or number of days you might need medical care. The calculator will then provide a cost estimate that you can use for financial planning, comparing different scenarios, and making informed decisions about where to seek treatment. Regular use of the calculator for various healthcare scenarios can help you build a comprehensive healthcare budget for your toddler.

“The Child Medical Calculator for Indian toddlers is an invaluable tool for parents seeking to plan and budget for healthcare expenses in an era of rising medical costs.”

What is the impact of medical inflation on toddler health insurance premiums in India?

Medical inflation has a direct and significant impact on toddler health insurance premiums in India. With medical costs rising at 14% annually, insurance companies have been increasing premiums at similar or even higher rates to cover their increased payouts. The average annual premium for child health insurance has risen from ₹4,000 in 2020 to ₹7,400 in 2024, representing an 85% increase in just four years. This trend is expected to continue, with projections indicating premiums could reach ₹8,500 by 2025. For families on tight budgets, these rising premiums create a difficult dilemma: maintain coverage at increasingly unaffordable rates or risk going without insurance and facing potentially catastrophic medical bills. This situation has led to a growing protection gap, where more children are left without adequate financial protection during medical emergencies.

“Medical inflation in India is driving toddler health insurance premiums to unsustainable levels, creating a financial crisis for many families seeking to protect their children’s health.”

How can I balance quality healthcare and affordability for my toddler in India?

Balancing quality healthcare and affordability for your toddler in India requires a strategic approach. One effective strategy is to utilize government healthcare facilities for routine services like vaccinations and basic checkups while reserving private hospitals for specialized treatments or emergencies. Another approach is to invest in comprehensive health insurance with adequate sum insured, which provides financial protection for major medical expenses while allowing you to choose quality healthcare when needed. Additionally, focusing on preventive healthcare through proper nutrition, hygiene, and timely vaccinations can prevent many common childhood illnesses, reducing the need for expensive treatments later. Comparing prices at different healthcare facilities and pharmacies, asking for generic medications, and maintaining organized medical records to avoid duplicate tests can also help reduce costs without compromising on quality.

“Strategic healthcare planning can help Indian parents provide quality medical care for their toddlers without breaking the family budget.”

What are the long-term financial implications of not having adequate health insurance for my toddler?

Not having adequate health insurance for your toddler can have severe long-term financial implications for your family. Without insurance, a single major illness or accident could result in medical bills ranging from ₹50,000 to ₹5,00,000 or more, potentially wiping out years of savings. Many families in this situation are forced to take high-interest loans, sell assets, or withdraw from retirement funds to cover medical expenses, significantly impacting their long-term financial goals and security. The financial stress can also lead to difficult choices, such as compromising on treatment quality or delaying necessary care, which can affect the child’s health outcomes. Additionally, without insurance, families may forgo preventive care and early interventions for minor health issues, leading to more serious and expensive health problems later.

“The long-term financial consequences of not having adequate health insurance for toddlers in India can be devastating, potentially derailing a family’s financial future for years to come.”

How does the cost of toddler healthcare in India compare to other countries?

The cost of toddler healthcare in India is significantly lower than in developed countries like the United States, Canada, or countries in Western Europe, but higher than in many developing nations. For instance, a routine pediatric consultation in India costs ₹300-₹1,500, compared to $100-200 (₹8,000-₹16,000) in the US. Similarly, hospitalization for a common condition like pneumonia costs ₹25,000-₹50,000 in India, compared to $10,000-20,000 (₹8,00,000-₹16,00,000) in the US. However, when adjusted for average income levels, healthcare costs in India represent a much larger portion of household budgets than in developed countries. Additionally, while absolute costs are lower in India, the rapid rate of medical inflation (14% annually) is higher than in most developed countries (typically 3-6%), making healthcare increasingly unaffordable for many Indian families.

“While toddler healthcare costs in India are lower in absolute terms compared to developed countries, they represent a larger financial burden for families when adjusted for income levels.”

Disclaimer

The information provided in this article is for educational and informational purposes only. While I am a qualified financial advisor and can provide expert guidance on financial planning for healthcare costs, I am not a medical professional. For all medical advice, treatment options, and healthcare decisions regarding your child, please consult with qualified pediatricians and healthcare professionals. The financial advice and strategies discussed in this article are based on current market conditions and available data, which are subject to change. Readers should conduct their own research and consider their individual financial situations before implementing any financial recommendations. For personalized financial advice regarding healthcare planning, insurance decisions, and budgeting for your child’s medical expenses, please feel free to contact me directly through our website at https://ourfinocracy.com/contact/. I am here to help you make informed financial decisions to protect your family’s financial wellbeing while ensuring your child receives the best possible healthcare.