Emergency Fund for Babies: Your Complete Financial Safety Net

Welcoming a baby brings immense joy but also significant financial responsibilities that many new parents underestimate. An emergency fund specifically for your baby isn’t just a luxury—it’s an absolute necessity in today’s unpredictable world. Unlike regular emergency funds, a baby-specific emergency fund must account for unique expenses like sudden medical treatments, specialized formula, emergency childcare, and unexpected developmental needs. This comprehensive guide will walk you through creating a robust financial safety net that ensures your little one never faces a crisis without adequate resources.

“Emergency Fund for Babies i.e. Baby emergency fund planning and newborn financial security are essential foundations for responsible parenting in modern India.”

Why Babies Need Their Own Emergency Fund

Babies come with their own set of unpredictable expenses that regular emergency funds might not adequately cover. From sudden hospitalizations to specialized medical equipment, the costs can add up quickly and overwhelm unprepared families. In India, a single neonatal ICU stay can cost anywhere from Rs. 50,000 to over Rs. 2 lakh depending on the city and hospital. Additionally, babies may develop allergies requiring expensive formula, need emergency surgeries, or require specialized therapies that aren’t fully covered by insurance. Having a dedicated baby emergency fund ensures you never have to choose between your child’s health and your financial stability.

“Newborn emergency expenses and infant medical fund requirements highlight the need for specialized financial planning for new parents.”

Calculating Your Baby’s Emergency Fund: 6-9 Months Rule

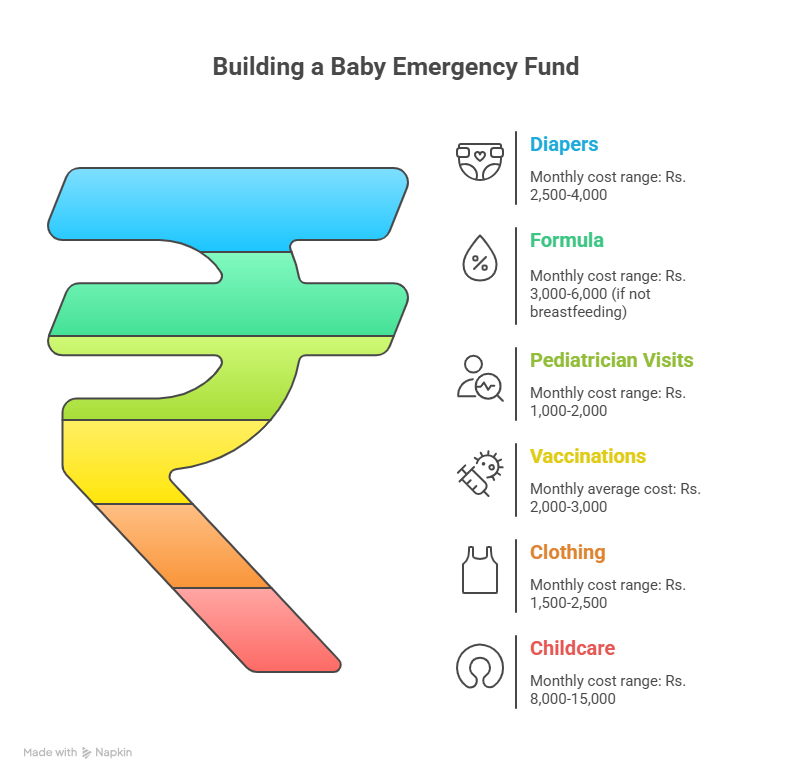

Financial experts recommend maintaining an emergency fund covering 6-9 months of baby-specific expenses, separate from your household emergency fund. To calculate this, list all baby-related monthly costs including diapers (Rs. 2,500-4,000), formula (Rs. 3,000-6,000 if not breastfeeding), pediatrician visits (Rs. 1,000-2,000), vaccinations (Rs. 2,000-3,000 monthly average), clothing (Rs. 1,500-2,500), and childcare (Rs. 8,000-15,000). For example, if your baby’s monthly expenses total Rs. 20,000, your baby emergency fund should ideally be between Rs. 1.2 lakh to Rs. 1.8 lakh. This amount provides a realistic buffer for most emergencies while accounting for inflation and unexpected cost increases.

“Baby emergency fund calculator and infant expense planning tools help parents determine appropriate financial safety nets for their newborns.”

Where to Park Your Baby’s Emergency Fund

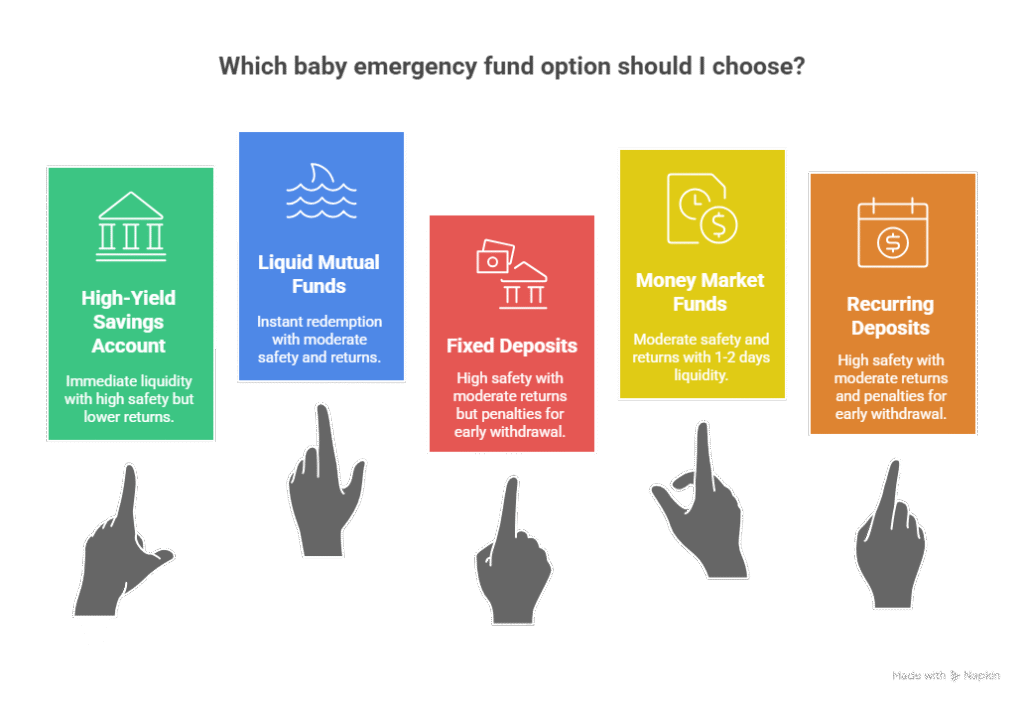

Choosing the right investment vehicle for your baby’s emergency fund is crucial—it should offer safety, liquidity, and reasonable returns. High-yield savings accounts are ideal as they provide immediate access while earning better interest than regular savings accounts (currently 4-7% in India). Liquid mutual funds offer another excellent option with returns of 6-8% and high liquidity through instant redemption facilities. Fixed deposits with banks provide safety and guaranteed returns but typically have penalties for early withdrawal. Money market funds combine safety with slightly higher returns but may have a 1-2 day redemption period. Avoid equity investments or long-term bonds for emergency funds as they lack the required liquidity and stability.

“Best place to keep baby emergency fund and infant emergency fund investment options must balance safety, accessibility, and returns for optimal financial security.”

Guardian Access Rules for Baby Emergency Funds

In India, emergency funds set up for babies have specific legal considerations regarding access and control. Funds held in the baby’s name require a guardian (typically a parent) to operate the account until the child turns 18. The guardian must provide legal documentation including birth certificates and identity proof to establish the guardian-minor relationship. For mutual fund investments in a minor’s name, the guardian controls the account until the child reaches majority, at which point the fund must be converted to the child’s own account. It’s crucial to name contingent guardians in your will to ensure uninterrupted access to these funds in case something happens to the primary guardian. Some parents opt for joint accounts with their spouse to ensure both have access, while others establish trusts with specific instructions for fund usage.

“Minor emergency fund access rules and baby fund guardian regulations ensure proper protection and control over infant emergency savings in India.”

Baby Emergency Fund vs Regular Emergency Fund

While both serve as financial safety nets, baby emergency funds differ significantly from regular household emergency funds. Baby funds focus exclusively on infant-related expenses and should be maintained separately to avoid being depleted for household emergencies. Regular emergency funds typically cover 3-6 months of total household expenses, while baby funds should cover 6-9 months of infant-specific costs. Baby funds may need to be larger due to potentially higher medical costs and the critical nature of baby-related emergencies. Additionally, baby funds might be accessed more frequently in the first year for various unexpected expenses, whereas regular emergency funds are ideally touched only for major crises. Both funds are essential, but they serve distinct purposes in your overall financial security strategy.

“Difference between baby emergency fund and regular emergency fund highlights the need for specialized financial planning for new parents.”

Emergency Fund for Babies i.e. Building Your Baby’s Emergency Fund: Step-by-Step

Start building your baby’s emergency fund even before birth if possible. Begin by opening a dedicated high-yield savings account specifically labeled for baby emergencies. Set up automatic monthly transfers from your salary account, starting with whatever amount you can manage—even Rs. 2,000-3,000 monthly adds up over time. Consider allocating a portion of baby gifts and monetary presents directly to this fund. Use any windfalls like tax refunds or bonuses to boost the fund. Track your progress using a baby emergency fund calculator available on many financial websites. Remember that building this fund is a marathon, not a sprint—consistent contributions will eventually reach your target amount.

“How to build baby emergency fund and newborn financial planning steps help parents create systematic savings strategies for infant financial security.”

Baby Emergency Fund Checklist

A comprehensive baby emergency fund should cover multiple categories of potential expenses. Medical emergencies top the list, including funds for hospitalization, surgeries, specialized treatments, and emergency transportation. Daily care contingencies should account for sudden formula changes due to allergies, special medical equipment, and emergency childcare arrangements. Developmental emergencies might include funds for early intervention therapies, specialized assessments, or adaptive equipment. Don’t forget to include emergency travel funds for accessing specialized medical care in other cities if needed. Finally, maintain a buffer for unexpected prescription medications, over-the-counter medical supplies, and emergency veterinary care if you have pets that might affect baby’s health.

“Baby emergency fund checklist India and newborn financial preparedness guide help parents anticipate and prepare for various infant emergency scenarios.”

Insurance and Your Baby’s Emergency Fund

While health insurance is crucial, it shouldn’t replace your baby’s emergency fund—rather, they should work together. Many newborn health insurance policies in India have waiting periods, co-payments, and sub-limits that leave significant out-of-pocket expenses. Additionally, some treatments or medications may not be covered at all. Your emergency fund should be large enough to cover these gaps in insurance coverage. Consider adding a critical illness rider to your health insurance that specifically covers congenital conditions and neonatal care. Remember that insurance claim processing can take time, so you’ll need immediate access to funds through your emergency fund while waiting for reimbursements.

“Newborn health insurance and baby emergency fund together provide comprehensive financial protection against infant medical emergencies in India.”

Maintaining and Growing Your Baby’s Emergency Fund

Once established, your baby’s emergency fund requires regular maintenance and occasional growth. Review the fund size every six months, adjusting for inflation and changes in your baby’s needs. As your child grows, some expenses may decrease while others (like medical check-ups) may increase. Rebalance the fund annually, moving any excess beyond your target amount into longer-term investments for your child’s future. Keep detailed records of all withdrawals and replenishments to track usage patterns and adjust your target amount accordingly. Consider setting up automatic annual increases in your contribution amount to account for inflation and ensure the fund maintains its purchasing power over time.

“Maintaining baby emergency fund and growing infant emergency savings require ongoing attention and adjustment as your child develops.”

Emergency Fund for Special Medical Needs

Some babies require specialized emergency funds due to pre-existing conditions, premature birth, or genetic factors. If your baby has special medical needs, work with your pediatrician to estimate potential emergency costs specific to their condition. These might include emergency medications, specialized equipment, or emergency transportation to specialized treatment centers. Consider establishing a separate sub-fund within your baby’s emergency fund specifically for these condition-related expenses. Connect with parent support groups for children with similar conditions to get realistic estimates of potential emergency costs. Remember that babies with special medical needs may require emergency funds 2-3 times larger than typically recommended for healthy infants.

“Special needs baby emergency fund and premature infant emergency savings require customized planning and larger financial buffers for unexpected medical expenses.”

Using Your Baby’s Emergency Fund Wisely

Establish clear guidelines for when to use your baby’s emergency fund to avoid depleting it for non-emergencies. True emergencies include situations that threaten your baby’s health, safety, or wellbeing and cannot be covered by regular income or insurance. Examples include emergency hospitalizations, life-threatening allergic reactions requiring immediate treatment, or essential medical equipment failures. Avoid using the fund for predictable expenses like regular vaccinations or routine check-ups, even if they’re expensive. When you do use the fund, make it a priority to replenish the withdrawn amount as quickly as possible, even if it means temporarily reducing other savings contributions. Keep detailed records of all withdrawals with receipts to track usage patterns and adjust your fund size if needed.

“When to use baby emergency fund and infant emergency fund withdrawal guidelines help parents maintain appropriate boundaries for accessing these critical savings.”

Comparison of Baby Emergency Fund Options

| Investment Option | Liquidity | Returns (Annual) | Safety | Minimum Investment | Tax Implications |

|---|---|---|---|---|---|

| High-Yield Savings Account | Immediate | 4-7% | High | Rs. 1,000 | Interest taxable |

| Liquid Mutual Funds | Instant redemption | 6-8% | Moderate | Rs. 500 | Dividend taxable |

| Fixed Deposits | Penalty for early withdrawal | 5-7.5% | High | Rs. 1,000 | Interest taxable |

| Money Market Funds | 1-2 days | 6.5-8.5% | Moderate | Rs. 500 | Dividend taxable |

| Recurring Deposits | Penalty for early withdrawal | 5-7% | High | Rs. 100 | Interest taxable |

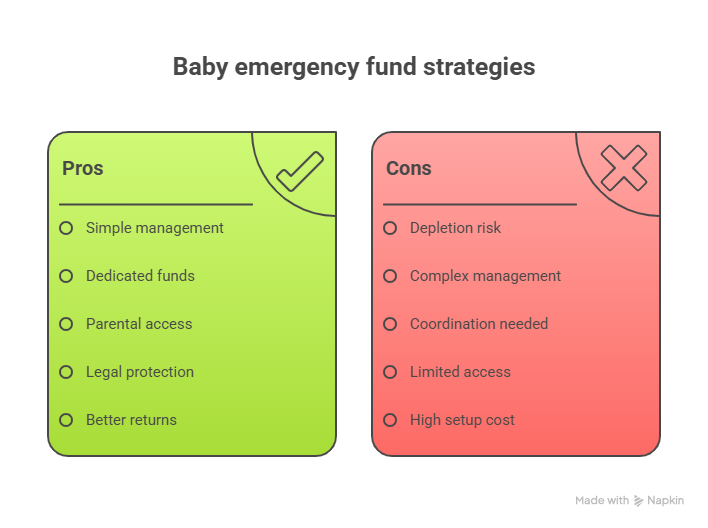

Pros and Cons of Different Baby Emergency Fund Strategies

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Single Large Fund | Simple to manage, clear tracking | May be depleted for household emergencies |

| Multiple Small Funds | Dedicated for specific purposes, harder to misuse | Complex to manage, may have lower returns |

| Joint Parental Account | Both parents have access, easy to operate | Requires coordination, potential for disputes |

| Minor’s Account with Guardian | Legal protection, dedicated for child | Limited access until child turns 18 |

| Trust Fund | Clear usage instructions, legal protection | Expensive to set up, complex management |

| Mixed Investment Portfolio | Better returns, diversified risk | Some portions less liquid, complex management |

How much emergency fund do I need for my baby in India?

Financial experts recommend maintaining 6-9 months of baby-specific expenses in your emergency fund. For most urban Indian families, this translates to Rs. 1.2 lakh to Rs. 2.5 lakh, depending on your location and lifestyle. Calculate this by totaling all monthly baby expenses including diapers, formula, pediatric visits, vaccinations, and childcare, then multiplying by 6-9.

“Baby emergency fund amount India and newborn emergency savings calculator help parents determine appropriate fund sizes for their specific situations.”

Can I use my regular emergency fund for baby emergencies?

While possible, it’s not advisable to use your regular household emergency fund for baby emergencies. Baby-specific costs can quickly deplete a general fund, leaving you vulnerable to other household emergencies. Maintaining separate funds ensures both your household and baby have adequate financial protection.

“Separate baby emergency fund and infant-specific emergency savings provide dedicated financial protection for newborn-related expenses.”

What’s the best place to keep my baby’s emergency fund in India?

High-yield savings accounts and liquid mutual funds are ideal for baby emergency funds in India. They offer the perfect combination of safety, liquidity, and reasonable returns. Look for banks offering 6-7% interest on savings accounts or liquid mutual funds with instant redemption facilities. Avoid long-term investments or equity instruments that can’t be accessed immediately in emergencies.

“Best investment for baby emergency fund India and infant emergency fund parking options must prioritize accessibility and safety over high returns.”

How do I access my baby’s emergency fund in an emergency?

For funds held in your name, access is immediate through ATM withdrawals, online transfers, or bank visits. For funds held in your baby’s name, you’ll need to provide guardian documentation including the minor’s birth certificate and your identity proof. Some parents maintain joint accounts with their spouse to ensure both can access funds quickly when needed. Always keep necessary documentation organized and easily accessible for emergencies.

“Baby emergency fund access rules and minor fund withdrawal procedures require proper documentation and planning for quick access during crises.”

Should I include my baby in my health insurance instead of having an emergency fund?

Health insurance and emergency funds serve different purposes and both are essential. While health insurance covers many medical expenses, it often has waiting periods, co-payments, deductibles, and coverage limits that leave significant out-of-pocket costs. An emergency fund covers these gaps plus non-medical baby emergencies that insurance doesn’t address.

“Newborn health insurance vs emergency fund comparison shows that both are necessary for comprehensive financial protection.”

How often should I review my baby’s emergency fund?

Review your baby’s emergency fund every six months and adjust annually. As your baby grows, their needs and expenses change, requiring fund size adjustments. Also review the investment performance and consider moving funds to better-yielding options while maintaining liquidity. Annual reviews should account for inflation and changes in your financial situation.

“Baby emergency fund review frequency and infant emergency fund maintenance schedules ensure ongoing adequacy of your financial safety net.”

Can grandparents contribute to my baby’s emergency fund?

Absolutely! Grandparents or other family members can contribute directly to your baby’s emergency fund. Many grandparents prefer giving monetary gifts for birthdays or festivals specifically for the baby’s financial security. Consider setting up a dedicated account where family members can make contributions directly. This not only boosts the fund but also involves extended family in your baby’s financial planning.

“Grandparents contributing to baby emergency fund and family gifts for infant financial security help build stronger financial foundations for newborns.”

What happens to my baby’s emergency fund when they turn 18?

When your child turns 18, funds held in their name become fully accessible to them as legal adults. At this point, you can work with them to either continue maintaining an emergency fund or transition the money to longer-term investments. Some parents choose to transfer the funds to a joint account they maintain with their adult child to provide guidance while gradually giving financial independence.

“Baby emergency fund after child turns 18 and minor fund transition to adult account require careful planning and communication with your growing child.”

How does a baby emergency fund differ from education savings?

Baby emergency funds are for immediate, unexpected expenses and must be highly liquid, while education savings are for long-term planned expenses and can be invested in growth-oriented instruments. Emergency funds should be easily accessible without penalty, whereas education funds might be in fixed deposits, mutual funds, or education-specific investment plans with longer horizons. Both are important but serve different financial purposes.

“Baby emergency fund vs education savings and infant financial planning priorities highlight the need for multiple specialized savings strategies.”

What if I can’t build the full emergency fund amount immediately?

Start small and build gradually—something is better than nothing. Begin with Rs. 10,000-20,000 and add whatever you can manage monthly, even if it’s just Rs. 1,000-2,000. Use windfalls like tax refunds or bonuses to boost the fund. Remember that building an emergency fund is a marathon, not a sprint—consistent contributions will eventually reach your target. Consider temporary lifestyle adjustments to accelerate savings until you reach your minimum comfort level.

“Building baby emergency fund gradually and newborn emergency fund saving strategies help parents start small and grow their financial safety net over time.”

Disclaimer

The information provided in this article is for educational purposes only and should not be considered as financial or legal advice. While we strive to provide accurate and up-to-date information, financial regulations and investment options may change. We recommend consulting with a qualified financial advisor or legal professional for advice tailored to your specific situation. For personalized financial planning assistance, please visit our services page. If you have questions or need further information about emergency fund planning, check out our financial quiz. or use our calculators to plan your baby’s emergency fund. For more articles on personal finance, visit our blog. To learn more about our approach to financial education, read about us. For inquiries or to share your feedback, please contact us. For engaging financial content in a visual format, explore our web stories.

Data sources used in this article include:

- Financial planning guidelines for new parents from major Indian financial institutions

- RBI regulations on minor accounts and guardian access

- SEBI guidelines on liquid mutual funds and emergency fund investments

- Medical expense data from major Indian hospitals and healthcare providers

- Insurance industry reports on newborn coverage and claim patterns