4 Surprising Reasons Why Showing Digital Payments Can Confuse Kids: Protecting Financial Understanding

Why Showing Digital Payments Can Confuse Kids: The Hidden Complexity of Invisible Money

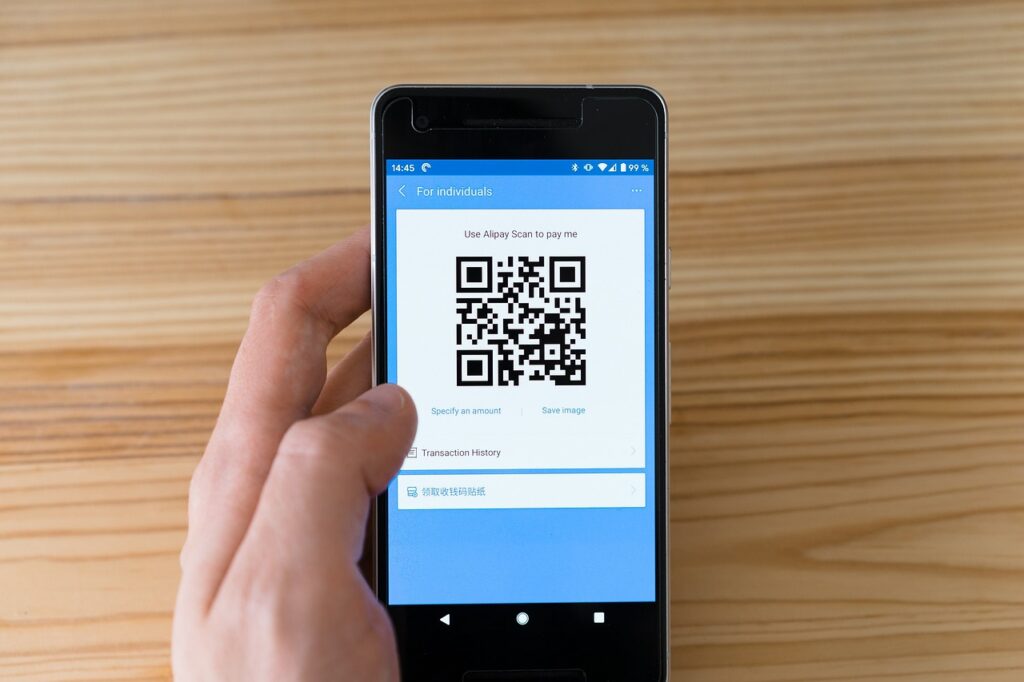

Why showing digital payments can confuse kids begins with a moment that opened my eyes to the problem. My 5-year-old daughter watched me tap my phone to pay for groceries, then asked, “Mama, can we get more toys? The phone has unlimited money!” That innocent question revealed why showing digital payments can confuse kids—the abstract nature of digital transactions creates fundamental misunderstandings about money that can last a lifetime. For more insights on healthy financial education, visit our blog.

“The convenience of digital payments creates a dangerous illusion for children—making money seem infinite and effortless. Understanding why showing digital payments can confuse kids is the first step toward teaching healthy financial concepts in the digital age.”

This comprehensive guide explores the surprising reasons why showing digital payments can confuse kids, offering parents essential insights into protecting their children’s financial understanding while navigating the inevitable digital world.

The Digital Money Paradox: Convenience vs. Comprehension

The Abstraction Problem in Young Minds

Research from the National Institute of Mental Health and Neurosciences reveals that children under age 8 struggle with abstract concepts, and digital payments are among the most abstract financial concepts they encounter. This explains why showing digital payments can confuse kids so profoundly.

“Children’s brains are wired for concrete thinking—they understand what they can see, touch, and count. Digital payments remove all these concrete elements, which is a major reason why showing digital payments can confuse kids.”

Our financial quiz can help parents identify potential confusion points in their children’s financial understanding.

The Developmental Timeline for Abstract Thinking

Understanding why showing digital payments can confuse kids requires knowing how abstract thinking develops:

Ages 3-5: Concrete operational stage—money must be physical and visible Ages 6-8: Transition to abstract thinking—beginning to understand symbols Ages 9-12: Abstract operational stage—can understand digital concepts Ages 13+: Formal operational stage—fully grasp abstract financial systems

The National Council of Educational Research and Training confirms that pushing abstract financial concepts before children are developmentally ready creates confusion and anxiety.

4 Key Reasons Why Showing Digital Payments Can Confuse Kids

1. The Invisible Money Illusion: When Money Seems Like Magic

The most fundamental reason why showing digital payments can confuse kids is that digital money appears invisible and infinite.

Confusion Mechanisms:

- No Physical Exchange: Children don’t see money changing hands

- Instant Gratification: Payment happens immediately without visible process

- Unlimited Appearance: Phone screens suggest endless supply

- No Tangible Loss: Nothing physical is given away

Real Impact: The Sharma family noticed their 6-year-old son believed the phone “magically created money” after watching digital payments. This demonstrates why showing digital payments can confuse kids—children literally don’t understand the financial transaction occurring.

Our household calculator can help parents demonstrate the concrete money behind digital transactions.

2. The Value Disconnect: When Numbers Lose Meaning

Another significant reason why showing digital payments can confuse kids is the disconnect between digital numbers and real-world value.

Cognitive Challenges:

- Scale Confusion: Children can’t comprehend large digital numbers

- Value Abstraction: Numbers on screens don’t represent tangible value

- Mathematical Gap: Children may not understand the arithmetic involved

- Context Loss: Digital payments lack the context of earning and spending

Developmental Impact: When children don’t understand why showing digital payments can confuse them, they may develop distorted views about money’s value—either seeing it as meaningless numbers or having unrealistic expectations about purchasing power.

3. The Security Paradox: When Safety Creates Confusion

The security features of digital payments, while necessary, create another reason why showing digital payments can confuse kids.

Security Confusions:

- Password Mystery: Hidden access makes money seem like a secret

- Protection Illusion: Security measures make money feel untouchable

- Access Complexity: Multiple security steps confuse the transaction process

- Privacy Concerns: Hidden information makes money seem mysterious

Real Example: A Mumbai mother discovered her 7-year-old daughter believed digital money was “safer” than cash because it was “protected,” leading to careless attitudes about spending. This illustrates why showing digital payments can confuse kids about money’s real value and security.

4. The Process Opacity: When Transactions Become Black Boxes

The final major reason why showing digital payments can confuse kids is the opacity of the transaction process—children see the beginning and end but not what happens in between.

Process Confusions:

- Hidden Steps: Children don’t see the money movement process

- Invisible Verification: Background checks and approvals are invisible

- Abstract Confirmation: Digital receipts lack physical confirmation

- Delayed Consequences: Financial impact isn’t immediately visible

Learning Barrier: This opacity is a key reason why showing digital payments can confuse kids—they don’t understand the complex financial processes occurring behind the simple tap of a phone.

Age-Specific Confusion: Why Showing Digital Payments Can Confuse Kids at Different Ages

For Children Ages 3-5

Primary Confusion: Money seems magical and infinite Manifestations: Believing phones create money, expecting unlimited purchases Psychological Need: Concrete understanding of money as physical objects Parental Response: Focus on physical money and simple explanations

For Children Ages 6-8

Primary Confusion: Numbers and value disconnect Manifestations: Difficulty understanding large amounts, confusing digital with real value Psychological Need: Bridging concrete and abstract thinking Parental Response: Connect digital numbers to real-world value

For Children Ages 9-12

Primary Confusion: Process and security complexity Manifestations: Misunderstanding transaction steps, overestimating security Psychological Need: Understanding abstract systems and processes Parental Response: Explain the technology and security behind digital payments

Our kiddie budget calculator can help create concrete connections between digital and physical money concepts.

The Long-Term Impact: Why Understanding Why Showing Digital Payments Can Confuse Kids Matters

Financial Literacy Development

When parents don’t understand why showing digital payments can confuse kids, children may develop:

- Distorted Value Concepts: Misunderstanding money’s real worth

- Poor Financial Boundaries: Difficulty understanding spending limits

- Delayed Financial Independence: Struggles with personal finance management

- Anxiety About Money: Confusion leading to financial stress

Relationship with Technology

The confusion about why showing digital payments can confuse kids affects children’s relationship with technology:

- Over-reliance on Digital: Preference for digital over physical money

- Security Misunderstandings: False sense of digital safety

- Technology Trust Issues: Either excessive trust or fear of digital systems

- Privacy Concerns: Poor understanding of digital financial privacy

Real-World Financial Behavior

Understanding why showing digital payments can confuse kids helps prevent:

- Impulsive Spending: Digital payments make spending feel effortless

- Budget Blindness: Difficulty tracking digital spending

- Credit Misunderstanding: Confusion about digital credit and debt

- Financial Responsibility: Poor personal financial management

Traditional vs. Digital Financial Education: Why the Gap Matters

| Aspect | Traditional Cash Education | Digital Payment Education |

|---|---|---|

| Tangibility | Physical coins and bills | Abstract numbers on screens |

| Process Visibility | Clear exchange of money | Hidden transaction processes |

| Value Understanding | Direct correlation with objects | Indirect number-to-value connection |

| Security Perception | Physical security of cash | Digital security features |

| Learning Curve | Simple, concrete concepts | Complex, abstract systems |

| Parental Guidance | Easy to demonstrate and explain | Challenging to make concrete |

| Child Comprehension | Higher immediate understanding | Higher confusion and misunderstanding |

Practical Strategies: Addressing Why Showing Digital Payments Can Confuse Kids

Strategy 1: Concrete-to-Digital Bridging

Implementation:

- Always show physical money before digital payments

- Connect digital transactions to physical cash equivalents

- Use visual aids showing the flow of money

- Create simple diagrams of digital payment processes

Goal: Reduce the primary reason why showing digital payments can confuse kids by making abstract concepts concrete.

Strategy 2: The “Money Behind the Screen” Approach

Implementation:

- Show bank statements and account balances

- Explain that digital money represents real physical money

- Demonstrate how digital transactions affect actual account balances

- Use simple apps that show money movement visually

Goal: Address the value disconnect, a key reason why showing digital payments can confuse kids.

Strategy 3: Process Transparency

Implementation:

- Explain each step of digital payment processes

- Use simplified diagrams of transaction flows

- Demonstrate security measures and their purpose

- Create visual representations of digital verification

Goal: Reduce process opacity, another major reason why showing digital payments can confuse kids.

Strategy 4: Balanced Payment Education

Implementation:

- Teach both cash and digital payment methods equally

- Create opportunities to use both payment types

- Compare advantages and disadvantages of each method

- Practice with both forms of payment in safe environments

Goal: Create comprehensive understanding that addresses all reasons why showing digital payments can confuse kids.

Our financial calculator can help demonstrate the concrete value behind digital transactions.

Real Family Experiences: Understanding Why Showing Digital Payments Can Confuse Kids

The Verma Family’s Realization

“We never understood why showing digital payments can confuse kids until our 7-year-old daughter asked if she could ‘download more money’ like she downloads games. We realized our digital-first approach had created serious misconceptions about money.”

Single Parent Experience

“As a single mom who relies heavily on digital payments, I was shocked to discover why showing digital payments can confuse kids. My 6-year-old son thought the phone had unlimited money because he never saw me using cash.”

Multi-Child Household Insights

“With children of different ages, we’ve seen firsthand why showing digital payments can confuse kids. Our 8-year-old understands digital payments better, but our 5-year-old still thinks money magically appears in phones.”

Pros and Cons of Digital Payment Education

The Benefits of Digital Payment Literacy

- Future Readiness: Prepares children for digital financial world

- Technological Comfort: Builds confidence with digital systems

- Security Awareness: Teaches digital financial safety

- Modern Financial Skills: Develops relevant money management abilities

The Challenges of Digital Payment Education

- Conceptual Confusion: Abstract nature creates misunderstandings

- Value Misunderstanding: Difficulty grasping real-world value

- Process Complexity: Hidden steps create confusion

- Security Misconceptions: False sense of digital safety

Your Questions About Why Showing Digital Payments Can Confuse Kids Answered

Q1: At what age do children typically become confused by digital payments?

A: Children as young as 3 can show confusion about why showing digital payments can confuse kids. The National Institute of Public Cooperation and Child Development confirms this confusion peaks around ages 5-8 when children can observe but not fully understand digital transactions.

Q2: How can I tell if my child is confused about digital payments?

A: Look for statements like “phone has unlimited money” or confusion about where money comes from. Understanding why showing digital payments can confuse kids helps identify these misconceptions early.

Q3: Should I avoid showing digital payments to my children altogether?

A: No, but be mindful about when and how. Understanding why showing digital payments can confuse kids helps you introduce digital concepts gradually and with concrete connections.

Q4: How do I explain that digital money isn’t infinite?

A: Connect digital payments to bank accounts and physical money. Our NRI setup calculator principles can help demonstrate finite money concepts.

Q5: What if my child is afraid of digital payments?

A: Some children develop anxiety about digital systems. Understanding why showing digital payments can confuse kids includes recognizing fear responses and addressing them with simple, reassuring explanations.

Q6: How do schools handle digital payment education?

A: Schools vary in their approach. The Central Board of Secondary Education recommends balancing traditional and digital financial education.

Q7: Can digital payment confusion lead to financial problems later?

A: Yes, early misconceptions can lead to poor financial habits. Understanding why showing digital payments can confuse kids helps prevent long-term financial issues.

Q8: How do cultural factors affect why showing digital payments can confuse kids?

A: Cultural attitudes toward money and technology influence confusion levels. The Ministry of Culture provides cultural context for financial education.

Q9: What role should grandparents play in digital payment education?

A: Grandparents can provide traditional money context. Understanding why showing digital payments can confuse kids helps grandparents bridge the traditional-digital gap.

Q10: How do I know if my digital payment education is working?

A: Look for accurate understanding of money concepts and ability to explain digital payments. Understanding why showing digital payments can confuse kids helps measure educational success.

Creating Financial Clarity in the Digital Age

Understanding why showing digital payments can confuse kids is essential for parents navigating the digital financial world. The convenience of digital payments creates invisible barriers to financial understanding that can last a lifetime if not addressed properly.

The journey toward healthy financial literacy begins with awareness—recognizing why showing digital payments can confuse kids and taking deliberate steps to make abstract concepts concrete and understandable. Every time you connect digital payments to physical money, explain the transaction process, or demonstrate the finite nature of digital funds, you’re building your child’s financial foundation.

Remember that understanding why showing digital payments can confuse kids doesn’t mean avoiding digital payments—it means teaching them thoughtfully and developmentally appropriately. By bridging the gap between concrete and abstract financial concepts, you’re giving your child the gift of financial clarity in an increasingly digital world. For personalized guidance on navigating digital financial education, explore our services page.

Disclaimer

This content is for educational purposes and does not constitute personalised financial advice. For personalised advice, visit our services or contact pages.