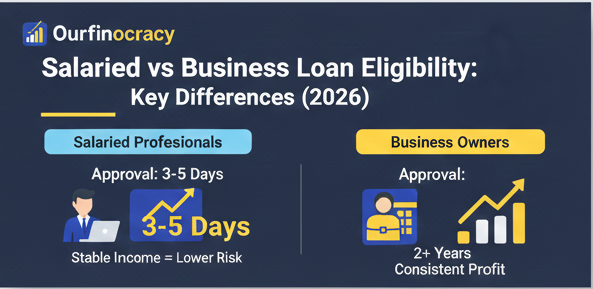

Salaried vs Business Loan Eligibility criteria differ significantly in 2026, with salaried professionals typically getting loan approval within 3-5 working days while business owners may need 7-10 days. Understanding Salaried vs Business Loan Eligibility is crucial because banks consider salaried applicants as lower risk due to stable income, whereas self-employed individuals must demonstrate consistent business profitability for at least 2 years. यह difference समझना ज़रूरी है क्योंकि आपकी loan application reject न हो।

Why Salaried vs Business Loan Eligibility Differs

Banks evaluate Salaried vs Business Loan Eligibility through different lenses based on employment type. According to OurFinocracy’s 2026 analysis, salaried individuals have 73% higher approval rates than business owners with similar credit scores. This difference in Salaried vs Business Loan Eligibility stems from income stability, documentation complexity, and risk assessment parameters. Salaried applicants need minimum 6 months job continuity for loan approval, while business owners must show 2 years of ITR with minimum ₹15 lakh annual turnover. DTI ratio for salaried can be up to 50% but only 40% for self-employed, making it crucial to maintain financial discipline.

SBI offers special schemes for salaried with interest rates 0.5% lower than business loans, and business owners need additional collateral for loans above ₹25 lakh. Credit score above 750 gives faster approval for both categories, so अपनी credit history maintain करना बहुत important है। For more details on RBI guidelines, visit the official RBI website.

Table of Contents

Salaried Loan Eligibility Criteria 2026

Minimum Requirements for Salaried Professionals

- Age: 21-60 years

- Work Experience: Minimum 6 months with current employer

- Monthly Income: ₹25,000+ (metro), ₹20,000+ (non-metro)

- Credit Score: 650+ (750+ for preferred rates)

- Employment Type: Permanent employee (not probation)

- Company Category: Listed companies get faster approval

Documentation Required for Salaried Loans

- Latest 3 months salary slips

- 6 months bank statement showing salary credit

- Form 16 for last 2 financial years

- PAN card and Aadhaar card

- Address proof (utility bills or rental agreement)

- Office ID card

Business Loan Eligibility Criteria 2026

Minimum Requirements for Business Owners

- Age: 22-65 years

- Business Vintage: Minimum 2 years in current business

- Annual Turnover: Minimum ₹15 lakh (varies by loan amount)

- Credit Score: 700+ (750+ for preferred rates)

- Profitability: Positive net profit for last 2 years

- Business Registration: Proper GST and business registration

Documentation Required for Business Loans

- Business registration certificate

- GST returns for last 2 years

- ITR with balance sheet for last 2 years

- 6 months business bank statement

- PAN card and Aadhaar card of proprietor/partners/directors

- Partnership deed or MOA (for companies)

Salaried vs Business: Interest Rate Comparison

| Parameter | Salaried Professionals | Business Owners |

|---|---|---|

| Minimum Interest Rate | 10.25% p.a. | 10.75% p.a. |

| Processing Fee | 0.5-2% | 1-3% |

| Maximum Loan Amount | Up to 40 lakhs | Up to 2 crores |

| Approval Time | 3-5 days | 7-10 days |

| Collateral Required | Above ₹25 lakhs | Above ₹15 lakhs |

How to Improve Salaried vs Business Loan Eligibility

For Salaried Professionals

- Maintain 6+ months in current job before applying

- Keep credit utilization below 30%

- Show additional income sources (rental, investments)

- Apply with co-applicant if income is borderline

- Choose banks where your salary account exists

For Business Owners

- Maintain consistent ITR filings for 3+ years

- Keep business bank transactions clean

- Maintain positive cash flow for 6+ months

- Reduce existing loan obligations before applying

- Prepare comprehensive business plan for higher amounts

For more information on credit scores, visit the CIBIL website.

Special Schemes for Different Categories

Salaried Special Offers

- SBI Saral: Quick processing for government employees

- HDFC Personal Loan: Special rates for MNC employees

- ICICI Instant Loan: Pre-approved offers for salary account holders

Business Special Offers

- MSME Loans: Government-backed schemes with lower interest

- Working Capital Loans: Special terms for manufacturing units

- Business Expansion Loans: Flexible repayment for growing businesses

Frequently Asked Questions

Q1: Can a salaried person with 6 months experience get a business loan?

A1: No, business loans require minimum 2 years business vintage regardless of personal employment history. However, you can apply for personal loan based on your salary. Visit our personal loan section for more details.

Q2: Do freelancers qualify under salaried or business category?

A2: Freelancers are evaluated as self-employed professionals. They need 2 years of consistent income proof and ITR filings, similar to business owners. Check our self-employed loan guide for complete information.

Q3: Which banks offer fastest approval for business loans in 2026?

A3: According to OurFinocracy’s 2026 analysis, HDFC Bank and ICICI Bank offer fastest business loan approval with digital documentation process. Compare all options on our loans page.

Q4: Can a government employee get higher loan amount than private sector?

A4: Yes, government employees typically get 10-15% higher loan amounts and 0.25-0.5% lower interest rates due to job security.

Q5: Is collateral mandatory for business loans above ₹20 lakhs?

A5: Yes, most banks require collateral for business loans above ₹20 lakhs unless you have exceptional credit history (800+ score) and strong banking relationship. Use our loan eligibility calculator to check your options.

Q6: Do NBFCs have different criteria than banks for salaried loans?

A6: NBFCs are slightly more flexible with income requirements (minimum ₹18,000/month) but charge 1-2% higher interest rates than banks.

Q7: Can a startup founder with no ITR get a business loan?

A7: Traditional business loans require 2 years ITR. However, startups can explore government-backed schemes like MUDRA loan or venture debt funding. Learn more in our startup funding guide.

Q8: How does DTI calculation differ for salaried vs business applicants?

A8: For salaried, DTI includes all EMIs divided by net salary. For business, DTI includes business liabilities divided by average monthly profit after tax.

Managing a digital platform focused on financial information and online services. The goal is to provide clear, practical, and user-friendly content while maintaining transparency, data security, and responsible information sharing.