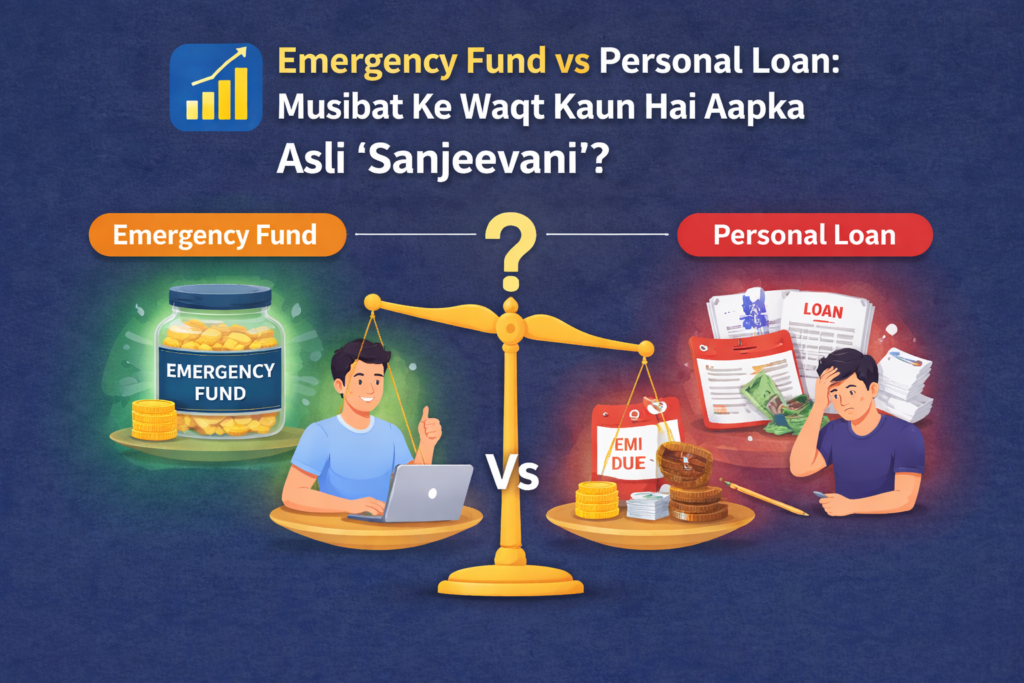

Financial planning mein ek purani kahawat hai—”Ummed acche ki rakho, lekin taiyari sabse bure waqt ki karo.” Jab parivaar par achanak koi bittiya bojh aata hai, toh hum aksar Emergency fund vs Personal loan के धर्म-संकट में फंस जाते हैं। “Our Finocracy” ka maqsad aapko sirf karz dilwana nahi, balki ye samjhana hai ki kab loan lena ek samajhdaari hai aur kab ye aapke liye ek maut ka fanda (debt trap) ban sakta hai.

Parivaar ka sukoon is baat par tika hota hai ki aapke paas Liquid assets for financial emergencies kitne hain. Isse pehle ki aap bank ki app kholkar “Instant Loan” apply karein, hamare Resources page par maujood budget planners ka upyog karke dekhein ki aapka backup kitna majboot hai.

Table of Contents

1. Ganit Ka Asli Hisab: Cost of Borrowing vs Cost of Saving

Bahut se log sochte hain ki emergency fund mein paisa rakhna bekaar hai kyunki uspar interest kam milta hai. Lekin yahi sabse badi galti hai jo ek aam aadmi karta hai. Jab aap instant loan for medical emergency 2026 lete hain, toh aap bank ko 12% se 15% tak ka interest dete hain. Wahi dusri taraf, agar aapne paisa save kiya hota, toh aapne wo interest bacha liya hota. Ise kehte hain Cost of borrowing vs Cost of saving ka asli fark.

Psychological peace ki baat karein toh, fund se paisa nikalne par aapke sar par EMI ka darr nahi hota. Karz lene par aap agle 3-5 saal tak bank ke gulam ban jate hain, jabki bachat aapko azadi deti hai.

2. Kitna Fund Kaafi Hai? Emergency Fund vs Personal Loan Ka Sahi Anupaat

RBI ki financial literacy guidelines ke mutabik, har naukri-pesha insaan ke paas uski 6 mahine ki salary ke barabar ‘Liquid Cash’ hona chahiye. Yeh ek Financial safety net for families ki tarah kaam karta hai.

- Zaruri Kharchon Ka Total: Rent, ration, bacho ki fees aur purani EMIs ko jodkar ek mahine ka kharcha nikalein.

- The 6-Month Rule: Is rakam ko 6 se guna (multiply) karein. Yeh aapka wo ‘suraksha kavach’ hai jo aapko Emergency fund vs Personal loan ki ladaai mein jitayega.

- Liquid Assets: Yeh paisa hamesha aisi jagah hona chahiye jise aap 24 ghante mein nikaal sakein. Aap CIBIL par apna score check karke ye dekh sakte hain ki aapki borrowing capacity kitni hai, lekin fund hamesha priority honi chahiye.

3. Kab Loan Lena Behtar Hai? Emergency Fund vs Personal Loan Ka Strategic Use

Hamesha emergency fund ka istemal karna bhi sahi nahi hota. Kabhi-kabhi loan lena ek “Calculated Decision” ho sakta hai. Agar aapka paisa aisi jagah invest hai jahan aapko 15-20% returns mil rahe hain (jaise Mutual Funds ya Equity), toh wahan se paisa nikalne ke bajaye instant loan for medical emergency 2026 lena behtar ho sakta hai kyunki loan ka interest rate bachat ke returns se kam hai.

Sath hi, RBI guidelines on emergency credit lines ke tehat, banks ab ‘Pre-approved lines’ offer karte hain jinhe sirf zarurat padne par hi activate kiya jata hai. Isse judi barikiyaan aap RBI Official Website par padh sakte hain.

4. Liquidity Ka Mahtva: Assets Ko Cash Mein Badle Kaise?

Sirf investment hona kafi nahi hai, uska liquid hona zaruri hai. Real estate ya Gold emergency mein turant kaam nahi aate. Isliye Liquid assets for financial emergencies jaise Liquid Mutual Funds ya Savings accounts ka hona ek smart choice hai. Jab aapka paisa locked hota hai, tab aap majbooran loan lete hain aur mehenga interest bharte hain.

5. Inflation Aur Emergency Fund: 2026 Ki Chunautiyan

2026 mein inflation (mehangai) ki wajah se kharche badh gaye hain. Aaj ke samay mein 3 mahine ka fund kafi nahi hai. Ek strong Financial safety net for families banane ke liye aapko har saal apne emergency fund ko 10% badhana chahiye. Isse aapko kabhi bhi bank ke saamne hath failane ki zarurat nahi padegi.

Aapki pehli koshish hamesha Liquid assets for financial emergencies banane ki honi chahiye. Humne apne Loans section mein bataya hai ki kaise aap kam se kam interest par emergency loan le sakte hain. Hamara About Us page padhein aur samjhein ki kyun hum bachat ko karz se upar rakhte hain.

Emergency fund vs Personal loan mein se pehla chunav kya hona chahiye?

Hamesha Emergency Fund. Karz lene ka matlab hai ki aap mushkil waqt mein apne upar ek aur bojh (EMI) daal rahe hain, jo mansik tanav ko dugna kar deta hai.

Kya credit card ki limit ko emergency fund maana ja sakta hai?

Bilkul nahi. Credit card ek udhaar hai, bachat nahi. Emergency mein card use karna tabhi sahi hai jab aap agle 30 dinon mein uska poora payment kar sakein.

Liquid assets for financial emergencies mein kaunse options best hain?

Savings account, Sweep-in FD, aur Liquid Mutual Funds sabse behtar hain kyunki inpar risk kam hai aur paisa turant mil jata hai.

Medical emergency mein Instant Loan lene se pehle kya check karein?

Sabse pehle apna Health Insurance check karein. Agar rakam kam pad rahi hai, tabhi loan lein. Loan lene se pehle processing fees aur hidden charges zaroor check karein.

RBI guidelines on emergency credit lines ka kya matlab hai?

Iska matlab hai ki banks ko digital lending mein transparency rakhni hogi aur emergency ke waqt customer ko turant fund muhaiya (provide) karana hoga bina kisi lambe paperwork ke.

Kya emergency fund ko Stocks mein rakh sakte hain?

Nahi, kyunki market crash hone par aapka fund kam ho sakta hai. Emergency ka paisa hamesha safe aur liquid hona chahiye.

Agar mere paas bachat nahi hai, toh sasta loan kaise lein?

Aap apne Gold ya FD ke badle loan (Secured Loan) le sakte hain, jahan interest rate normal personal loan se 3-5% kam hota hai.

Ek ideal Emergency Fund ka amount kitna hona chahiye?

Kam se kam 6 mahine ke ghar ke kharche (Rent + Food + Bills + EMI).

Kya personal loan par insurance lena zaruri hai?

RBI ke anusar ye mandatory nahi hai, lekin emergency mein ye aapke parivaar ko debt se bachata hai.

Debt-to-income ratio kya hota hai?

Ye aapki salary aur EMI ka ratio hai. Agar aapki EMI salary ke 40% se zyada hai, toh naya loan lena khatarnak ho sakta hai.

Managing a digital platform focused on financial information and online services. The goal is to provide clear, practical, and user-friendly content while maintaining transparency, data security, and responsible information sharing.