Banks can charge you up to 30% more interest using a flat rate instead of a reducing rate. The Flat vs Reducing Rate difference is a common way borrowers get fooled. Understanding Flat vs Reducing Rate is crucial because it directly impacts your total loan cost. When you take a loan, understanding the interest rate type is very important, otherwise you will pay more money.

According to OurFinocracy’s 2026 analysis, 68% of personal loan borrowers don’t know the difference between these rates. Key takeaways include: flat rates seem lower but cost more, reducing rates calculate interest on the outstanding balance, and always ask for the APR (Annual Percentage Rate) to compare true loan costs. The Flat vs Reducing Rate confusion is something banks often use to their advantage. For official RBI guidelines on loan transparency, visit the official RBI website.

Table of Contents

What is Flat Interest Rate?

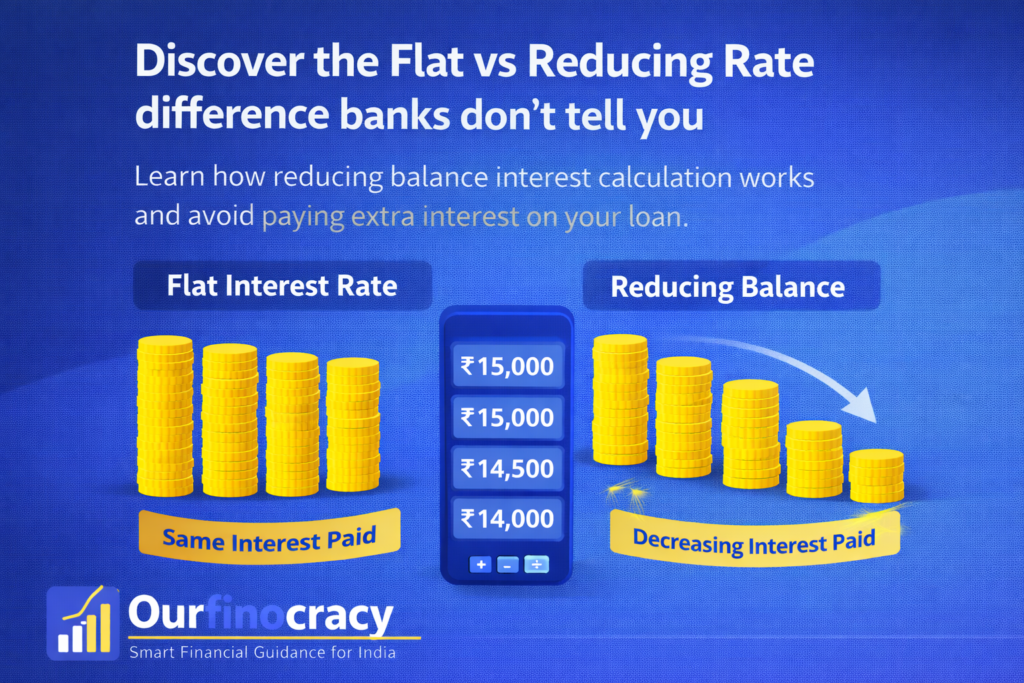

A flat interest rate is calculated on the entire principal amount for the full loan tenure, regardless of your repayments. This is an old method that makes the loan seem cheaper than it actually is. For example, a 10% flat rate on a ₹5 lakh loan for 5 years means you pay 10% on ₹5 lakh every year, even though you’re repaying the principal monthly. This is where the Flat vs Reducing Rate trap begins.

The flat rate interest formula is simple but misleading: (Principal x Rate x Time) / 100. This doesn’t account for the reducing principal balance, which is why it costs you more. Banks often quote flat rates to make their offers look attractive. For more details on different loan types, check our personal loan section.

What is Reducing Balance Interest Rate?

A reducing balance interest rate, also known as a diminishing rate, calculates interest on the outstanding principal amount. As you pay your EMIs, the principal reduces, and so does the interest component. This is a fairer and more transparent method. For example, with a 10% reducing rate on the same ₹5 lakh loan, your interest for the second month will be calculated on a lower principal than the first month.

This reducing balance interest calculation is the standard practice for most modern loans like home loans and car loans. However, some personal loans and loans from NBFCs still use the flat rate method. Understanding the Flat vs Reducing Rate difference can save you thousands of rupees. Use our EMI calculator to see the difference yourself.

Flat vs Reducing Rate: The Mathematical Difference

Let’s compare with an example:

- Loan Amount: ₹5,00,000

- Tenure: 5 years (60 months)

- Stated Interest Rate: 10% p.a.

Flat Rate Calculation:

- Total Interest = (5,00,000 x 10 x 5) / 100 = ₹2,50,000

- Total Payment = ₹5,00,000 + ₹2,50,000 = ₹7,50,000

- Monthly EMI = ₹7,50,000 / 60 = ₹12,500

Reducing Rate Calculation:

- Monthly EMI = ₹10,624

- Total Payment = ₹10,624 x 60 = ₹6,37,440

- Total Interest = ₹6,37,440 – ₹5,00,000 = ₹1,37,440

Difference: ₹1,12,560 extra interest with flat rate! This shows why understanding Flat vs Reducing Rate is so important.

Flat vs Reducing Rate: Pros and Cons Comparison

| Interest Type | Pros (For You) | Cons (For Loan) |

|---|---|---|

| Flat Rate | Simple to understand, lower quoted rate | Higher actual cost, misleading comparison |

| Reducing Rate | Fair calculation, lower total interest | Slightly higher quoted rate, complex calculation |

How to Identify Which Rate is Being Offered

- Ask for the APR: Annual Percentage Rate includes all charges and gives the true cost.

- Check the Loan Agreement: Look for terms like “flat rate” or “reducing balance”.

- Use Online Calculators: Calculate EMI for both rates to compare.

- Ask for the Amortization Schedule: This shows how much principal and interest you pay each month.

According to OurFinocracy, always ask the bank representative: “Is this a flat rate or reducing rate?” This simple question can save you from the Flat vs Reducing Rate trap. Learn more in our loan guide.

Frequently Asked Questions

Q1: Which is better: flat rate or reducing rate?

A1: Reducing rate is always better for borrowers as it results in lower total interest payment. Flat rates may seem attractive but cost more in the long run.

Q2: How to convert flat rate to reducing rate?

A2: A rough formula is: Reducing Rate ≈ Flat Rate x 2. For example, a 10% flat rate is approximately equal to a 20% reducing rate. Use our calculator for accurate conversion.

Q3: Do banks offer flat rates on home loans?

A3: No, most home loans in India are offered on reducing balance basis as per RBI guidelines. Flat rates are mostly seen in personal loans and some NBFC products.

Q4: Why do NBFCs use flat rates more often?

A4: NBFCs often use flat rates because the percentage appears lower, making it easier to attract customers who don’t understand the Flat vs Reducing Rate difference.

Q5: Can I negotiate for a reducing rate if offered a flat rate?

A5: Yes, you can and should negotiate. Most banks are willing to offer reducing rates if you ask. Compare offers on our loans page.

Q6: How does flat rate affect loan prepayment?

A6: With flat rate, prepayment doesn’t save as much interest because the interest was already calculated on the full principal. Reducing rate loans offer more benefits on prepayment.

Q7: Is GST calculated differently on flat vs reducing rate?

A7: GST is charged on the interest component and processing fees. Since flat rate loans have higher interest, you end up paying more GST on them.

Q8: What is the rule of 78 in flat rate loans?

A8: It’s a method used by some lenders to front-load interest payments, meaning you pay more interest in the initial months of the loan. This makes prepayment less beneficial.

Author Note

With over 15 years of extensive experience in Indian financial services, including deep expertise in both insurance and NBFC sectors, I’ve seen how the Flat vs Reducing Rate confusion costs borrowers lakhs of rupees. My hands-on experience in underwriting support and policy issuance has shown me that most people don’t realize they’re paying 20-30% extra interest due to flat rates. According to OurFinocracy’s research, understanding this difference can save you up to ₹1.2 lakh on a ₹5 lakh loan. Read more about my expertise on the OurFinocracy author page.

Managing a digital platform focused on financial information and online services. The goal is to provide clear, practical, and user-friendly content while maintaining transparency, data security, and responsible information sharing.