Money Saving Tips For Kids Aged-0-5

For Our Lovely Kids’ belongs from Rural and Semi-Urban India and America A Comprehensive Guide for Rural, Semi-Urban, and Urban Families

As parents, we dream of giving our children the tools they need to build a bright and secure future. Teaching them the value of money is not just about rupees, dollars and cents—it’s about instilling responsibility, gratitude, and a sense of independence. Imagine the pride you’ll feel when your child confidently saves for their first dream or steps into adulthood prepared to make wise financial decisions. Start today by showing them that saving isn’t about restriction; it’s about opening doors to their dreams. Because every coin saved today is a step closer to the life they deserve tomorrow. So Let’s Enjoy to and know more about Money-Saving Tips for Kids Aged 0-5 in Rural and Semi-Urban India and America

Introduction: Building Financial Foundations Early

Financial literacy is a life skill that’s often overlooked during early childhood. Yet, the habits and attitudes children develop between ages 0-5 form the basis for their future financial decisions. Whether in the bustling streets of Mumbai, the quiet countryside of Kansas, or semi-urban towns across the globe, parents, schools, and communities play a crucial role in shaping financial awareness from an early age.

This guide bridges cultural, regional, and socioeconomic contexts, offering actionable money-saving tips for kids aged 0-5 in rural, semi-urban, and urban settings. From the humble gullak in Indian villages to savings jars in American homes, the concepts of saving, budgeting, and responsible spending remain universal.

Understanding Financial Literacy in Early Childhood for Money-Saving Tips for Kids Aged 0-5

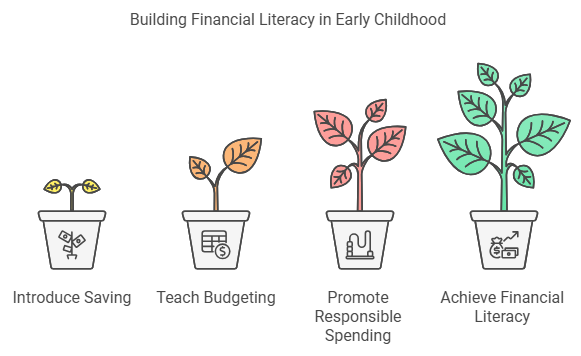

Financial literacy for children aged 0-5 focuses on introducing basic concepts like recognizing money, saving, and understanding needs versus wants. At this stage, it’s less about math and more about building habits and attitudes through playful learning.

Cultural Perspectives on Financial Education

Money-Saving Tips for Kids Aged 0-5 in Rural and Semi-Urban India

• Traditional Practices: Gullaks, festival-based savings, and involvement in local markets.

• Challenges: Limited digital access, reliance on cash economies.

Money-Saving Tips for Kids Aged 0-5 in Rural and Semi-Urban America

• Hands-On Learning: Chores tied to allowances, community yard sales, and farm-related lessons.

• Challenges: Dependence on local resources for education.

Saving Habits and Practical Tools

Introducing the Gullak or Savings Jar

Discuss cultural tools like gullaks in India and transparent jars in America, emphasizing how they teach children the concept of accumulation.

Pocket Money and Budgeting Basics

Introduce allowances and chore-based earnings to instill a sense of responsibility and the value of effort.

Differentiating Wants vs. Needs

Use storytelling and real-life examples to teach young children how to prioritize essential spending over impulse buying.

The Role of Generosity in Financial Literacy

Encourage saving for charity through “giving jars,” aligning lessons with cultural practices like Diwali donations in India or community drives in America.

Technology and Financial Education Tools

Introduce apps and digital tools suitable for semi-urban families to complement traditional practices.The Role of Schools and Communities in Teaching Financial Literacy

Why Schools and Communities Matter?

Activity-Based Learning:

Preschools in both rural and urban settings use hands-on activities to teach financial concepts.

Indian Example: Montessori schools in semi-urban areas may include play-based exercises, such as sorting coins into denominations or role-playing markets.American Example: Preschools often set up pretend stores, encouraging children to “buy” items with play money to understand transactions.

Incorporating Stories and Songs:

Teachers can use stories to teach kids about saving and generosity.

Example: Narrating tales where characters save for something important, like a toy or an adventure.

Community-Based Initiatives

Communities, especially in rural and semi-urban areas, act as crucial agents of financial education. They bring practical lessons to children through festivals, fairs, and other local activities.

Money-Saving Tips for Kids Aged 0-5 in Indian Context:

During village fairs, children can participate in small buying-and-selling activities with guidance from parents or community leaders.

Local NGOs sometimes organize workshops for young mothers, teaching them how to introduce savings concepts to their toddlers.

Money-Saving Tips for Kids Aged 0-5 in American Context:

Small-town libraries often host “Financial Literacy Storytime,” where books about money are read aloud to preschoolers.

Community centers may organize fundraising activities where children contribute small amounts to a shared goal, such as a new playground.

Learning Through Real-Life Experiences

Using Everyday Activities as Teaching Moments

Discuss how routine errands like shopping or visiting a local market can become financial lessons.

Emotional Stories That Resonate

Inspire readers with stories of young children from different regions learning financial independence, generosity, and budgeting.

A Global Perspective on Financial Education

Discuss how financial literacy is taught in early childhood globally, offering insights from both Indian and American rural and semi-urban settings.

Conclusion: A Lifelong Gift

Early financial literacy is not just about managing money—it’s about instilling confidence, discipline, and independence. By working together, parents, schools, and communities can ensure that children aged 0-5 grow up equipped with the knowledge and habits they need for financial success.

1 comment