Pros and Cons of GST Slabs 2025

India witnessed a historic Goods and Services Tax (GST) reform on 3 September 2025, when the GST Council announced a complete restructuring of tax slabs. This is being called the biggest indirect tax reform since GST was first introduced in 2017. The aim is to simplify taxation, ease compliance, and reduce costs for the common man. Lets know Pros and Cons of GST Slabs 2025

If you’re wondering about the new GST slab 3 September 2025 item list, what gets cheaper after GST 2025, and the pros and cons of GST reform 2025, this guide gives you everything in one place.

👉 For more finance insights, check our blog.

GST Council Meeting September 2025 Highlights

The GST Council meeting on 3 September 2025 is being hailed as a landmark decision. Here are the key highlights:

- Slabs reduced: From 4 to 2 main slabs (5% and 18%), plus 40% slab for luxury/sin goods.

- Old 12% & 28% slabs abolished.

- Effective from 22 September 2025.

- Insurance (life & health) becomes GST-free (0%).

- Everyday essentials like food, toiletries, and household goods moved to lower slab.

- Luxury & sin goods (cigarettes, tobacco, aerated drinks, high-end cars) taxed at 40%.

In short, the GST Council meeting September 2025 highlights prove that the government wants to simplify taxation and give relief to middle-class households.

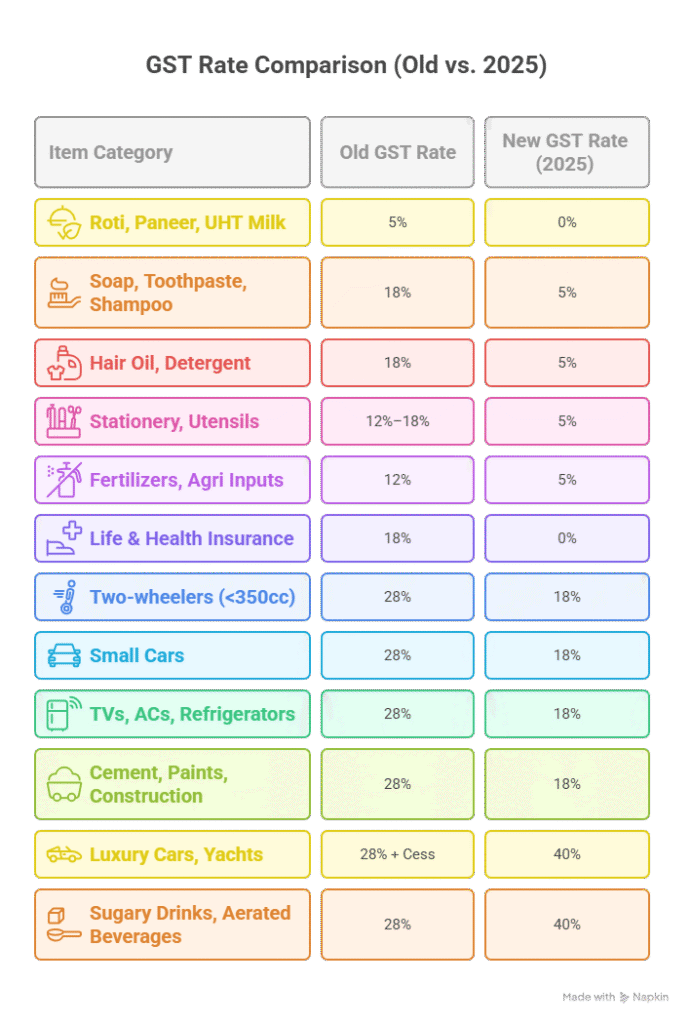

GST Rate Old vs New 2025 Comparison Table

If you’ve been searching for the gst rate old vs new 2025 comparison table, here’s the detailed breakdown:

| Item Category | Old GST Rate | New GST Rate (2025) |

|---|---|---|

| Roti, Paneer, UHT Milk | 5% | 0% |

| Soap, Toothpaste, Shampoo | 18% | 5% |

| Hair Oil, Detergent | 18% | 5% |

| Stationery, Utensils | 12%–18% | 5% |

| Fertilizers, Agri Inputs | 12% | 5% |

| Life & Health Insurance | 18% | 0% |

| Two-wheelers (<350cc) | 28% | 18% |

| Small Cars | 28% | 18% |

| TVs, ACs, Refrigerators | 28% | 18% |

| Cement, Paints, Construction | 28% | 18% |

| Luxury Cars, Yachts | 28% + Cess | 40% |

| Sugary Drinks, Aerated Beverages | 28% | 40% |

This old vs new GST 2025 comparison table makes it clear how much relief the common consumer gets and where luxury consumption will cost more.

0% GST Items List 2025 India

One of the most impactful reforms announced is the introduction of 0% GST items list 2025 India. These are essentials that now carry no GST at all, giving direct relief to consumers.

- Roti & basic Indian breads

- Paneer & khakhra

- UHT milk & packaged milk products

- Life insurance policies

- Health insurance premiums

By making these items GST-free, the government has directly reduced household expenses for millions of families.

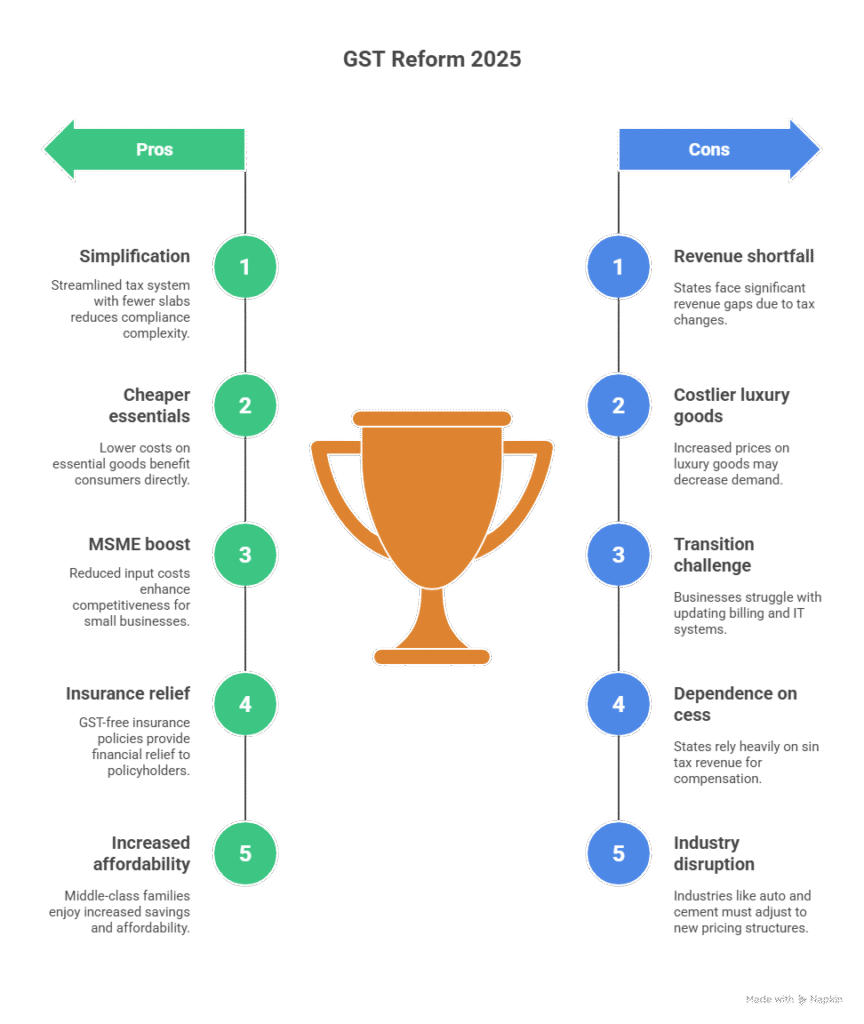

Pros and ❌ Cons of GST Reform 2025

Like every reform, the pros and cons of GST reform 2025 must be evaluated.

| ✅ Pros | ❌ Cons |

|---|---|

| Simplification: Only two slabs plus luxury bracket | Revenue shortfall: States may face ₹48,000+ crore gap |

| Cheaper essentials: Direct benefit to consumers | Luxury/sin goods costlier: Demand may fall |

| Boost to MSMEs & agriculture: Lower input costs | Transition challenge: Businesses must update billing & IT |

| Insurance relief: Life & health now GST-free | Dependence on cess: States reliant on sin tax revenue |

| Increased affordability: Middle-class families save more | Industry disruption: Auto, cement, FMCG must reset prices |

What Gets Cheaper After GST 2025?

One of the most asked questions is: what gets cheaper after GST 2025?

- Food & Essentials: Roti, paneer, khakhra, UHT milk → 0% GST

- Daily-use FMCG: Soap, toothpaste, shampoo, hair oil, detergent → 5% GST

- Household items: Stationery, utensils → 5% GST

- Agriculture: Fertilizers, machinery inputs → 5% GST

- Insurance: Life & health insurance → 0% GST

- Consumer durables: TVs, ACs, refrigerators, cement, small cars → 18% GST (earlier 28%)

What Gets Costlier in 2025?

- Cigarettes, tobacco, gutkha, pan masala → 40% GST

- Sugary drinks & aerated beverages → 40% GST

- Luxury vehicles, yachts, high-end SUVs → 40% GST

Sector-Wise Impact

FMCG (Soap, Shampoo, Toothpaste)

Biggest winners. Products now taxed at 5% instead of 18%, making essentials more affordable.

Auto & Mobility

- Small cars & two-wheelers: GST down from 28% → 18%.

- Expected boost in middle-class vehicle purchases.

Insurance

- Life & health insurance: Now GST-exempt.

- Encourages financial security & wider adoption.

Real Estate & Construction

- Cement, paints, construction inputs: 28% → 18%.

- Home building & repairs expected to become cheaper.

Agriculture & MSME

- Fertilizers & inputs at 5% → better margins for farmers & small businesses.

Consumer Savings Example

- A shampoo bottle priced at ₹100 (base price):

- Old price = ₹100 + 18% GST = ₹118

- New price = ₹100 + 5% GST = ₹105

- Savings: ₹13 on every bottle

- A cement bag worth ₹400:

- Old price = ₹400 + 28% GST = ₹512

- New price = ₹400 + 18% GST = ₹472

- Savings: ₹40 per bag

1. What is the new GST slab 3 September 2025 item list?

The list includes essentials like roti, paneer, and insurance (0%), FMCG at 5%, durables at 18%, and luxury/sin goods at 40%.

2. Where can I see the GST rate old vs new 2025 comparison table?

You can find the full comparison table above, showing which goods shifted from higher slabs (28%) to lower slabs (18% or 5%).

3. What gets cheaper after GST 2025?

Essentials, FMCG, insurance, construction items, and consumer durables all become more affordable under the new slabs.

4. What are the GST Council meeting September 2025 highlights?

Highlights include abolition of 12% & 28% slabs, simplification to 5% & 18%, and a 40% luxury/sin goods slab.

5. What are the pros and cons of GST reform 2025?

Pros: simplified system, cheaper essentials, boost to MSMEs.

Cons: state revenue shortfall, higher tax on luxury items, compliance cost.

6. Which goods are in the 0% GST items list 2025 India?

Roti, paneer, khakhra, UHT milk, and insurance policies are now in the 0% GST bracket, making them tax-free

Why This Reform Matters

- Simplification: Easy compliance for businesses.

- Festive relief: Effective from Navratri 2025, before Diwali – directly benefits consumers.

- Economic push: Expected to boost consumption and GDP growth.

- Middle-class friendly: Reduces cost of living significantly.

👉 For financial tools to calculate your GST savings, explore our calculators.

Need Expert Help?

We at OurFinocracy help individuals and businesses navigate tax reforms and optimize finances.

- Learn about us

- Explore our services

- Have queries? Contact us