RBI New Credit Reporting Rule

RBI’s New Credit Reporting Rule: A Game-Changer for Borrowers

In a move set to transform the financial landscape, the Reserve Bank of India (RBI) has introduced a groundbreaking credit reporting rule. Effective from January 1, 2025, lenders must now report credit information to Credit Information Companies (CICs) every fortnight, as opposed to the previous monthly cycle. This initiative (RBI’s New Credit Reporting Rule) has far-reaching implications for borrowers, promising quicker credit score updates and improved financial access.

This article delves into the details of this transformative regulation, its benefits for borrowers, and how you can leverage it to maintain a healthy credit profile.

Understanding the Importance of Credit Scores

Your credit score is a critical factor in determining your financial health and access to credit. It acts as a mirror reflecting your financial discipline and repayment ability.

- What is a Credit Score?

A credit score is a three-digit number ranging from 300 to 900, indicating your creditworthiness. Scores above 750 are generally considered excellent, opening doors to better financial products and lower interest rates. - Factors Influencing Your Credit Score:

- Payment History: Late payments can significantly lower your score.

- Credit Utilization Ratio: High usage of credit limits can harm your score.

- Length of Credit History: Longer histories positively impact your score.

- Credit Mix: A diverse mix of credit types, such as credit cards and loans, can boost your score.

RBI’s New Credit Reporting Rule Explained

The RBI’s mandate for fortnightly credit reporting is a progressive step toward enhancing transparency and efficiency in credit evaluation.

- What’s Changed?

Previously, lenders submitted credit data to CICs like CIBIL, Experian, and Equifax monthly. The new rule requires fortnightly updates, ensuring credit scores reflect the latest borrower activity. - Why the Change?

Delays in credit reporting often resulted in outdated credit scores, limiting borrowers’ ability to secure loans or negotiate favorable terms promptly. The new system addresses this lag, aligning credit scores more closely with borrowers’ current financial behavior.

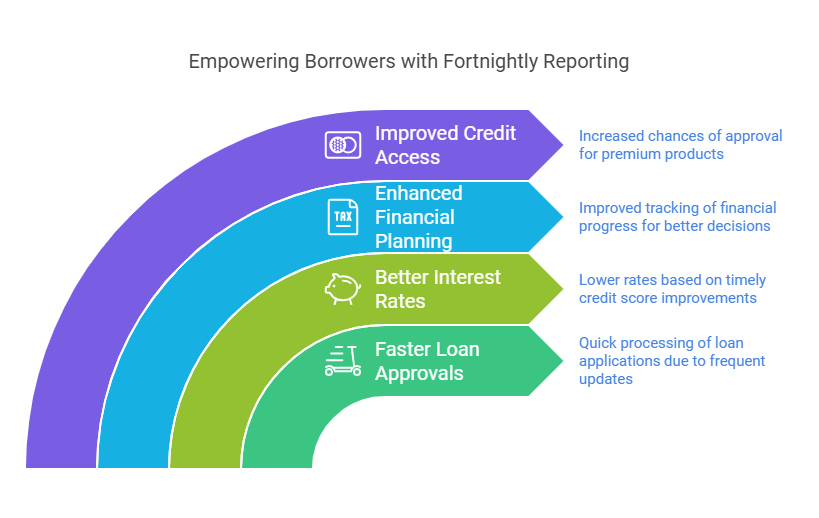

Benefits for Borrowers

The fortnightly reporting rule has several advantages that empower borrowers:

Faster Loan Approvals

With more frequent credit score updates, lenders can process loan applications swiftly. Borrowers showcasing timely payments can expect quicker approvals.

Better Interest Rates

Lenders base interest rates on credit scores. Rapid updates reflecting good financial behavior can translate to lower interest rates.

Enhanced Financial Planning

Updated scores allow borrowers to track their financial progress more accurately, enabling better financial decisions and credit management.

Improved Credit Access

Whether applying for credit cards or loans, an up-to-date score improves approval chances, even for premium financial products.

How to Maintain a Strong Credit Score

While RBI’s rule facilitates quicker updates, maintaining a strong credit score remains the borrower’s responsibility.

Timely Payments

Pay all bills and dues on time to avoid penalties and negative impacts on your score.

Low Credit Utilization

Aim to keep your credit utilization ratio below 30% of your total credit limit.

Regular Credit Monitoring

Use free credit score services to stay informed. Dispute discrepancies promptly to prevent score damage.

Minimize Credit Applications

Avoid applying for multiple credit products simultaneously, as frequent inquiries can lower your score.

Comparison Table: Monthly vs. Fortnightly Reporting

| Feature | Monthly Reporting | Fortnightly Reporting |

| Update Frequency | Once a month | Every two weeks |

| Impact on Credit Scores | Delayed | Timely and accurate |

| Loan Approval Speed | Slower | Faster |

| Borrower Benefits | Limited | Enhanced |

Why This Rule Matters for Borrowers

The fortnightly reporting system levels the playing field, especially for borrowers working toward improving their credit profiles. Timely updates reflect efforts like settling dues or reducing credit utilization, motivating responsible financial behavior.

Impact on Financial Institutions

This regulation also imposes stricter compliance requirements on lenders. By submitting data more frequently, they enhance borrower trust and ensure fair credit practices.

How to Check Your CIBIL Score Free Online

Knowing your credit score is now simpler than ever. Here are easy steps to check it for free:

- Visit the official CIBIL website

- Enter details like PAN card number and basic credentials.

- Receive your updated score instantly.

How often can I check my credit score?

You can check your credit score anytime, but doing it quarterly is sufficient to monitor changes.

Does checking my CIBIL score affect it?

No, checking your score is considered a soft inquiry and does not impact it.

What is the minimum score for a personal loan?

A score of 750 or above is ideal for getting favorable loan terms.

Can I get a loan with a low credit score?

Yes, but terms might be less favorable. Consider improving your score before applying.

How does RBI’s rule affect credit cards?

It improves approval rates for cards as recent financial activities are reflected faster.

Conclusion

RBI’s new credit reporting rule is a monumental step toward empowering borrowers with accurate and timely credit information. By adopting best practices to maintain a healthy score, you can fully leverage this initiative for your financial success.

Post Comment