Changes in Semiconductor Prices in India from 2025 Onwards

The semiconductor industry is a critical component of the global economy, influencing various sectors such as electronics, automotive, and telecommunications. As India continues to expand its technology landscape, understanding the future changes in semiconductor prices is essential, especially in light of ongoing geopolitical tensions, particularly between China and Taiwan. This article explores the anticipated changes in semiconductor prices in India from 2025 onwards, incorporating market trends, geopolitical factors, and domestic initiatives.

Current Landscape of the Semiconductor Market

Taiwan’s Dominance in Semiconductor Production

Taiwan is home to some of the world’s largest semiconductor manufacturers, including Taiwan Semiconductor Manufacturing Company (TSMC), which produces a significant portion of the global chip supply. The country’s advanced manufacturing technologies and skilled workforce position it as a leader in the semiconductor sector.

- Key Players:

- TSMC: The largest contract chip manufacturer globally.

- UMC (United Microelectronics Corporation): A major player specializing in specialty chips.

- Powerchip Semiconductor Manufacturing Corporation (PSMC): Focuses on memory chips.

India’s Growing Demand for Semiconductors

India’s semiconductor market is experiencing rapid growth driven by increased demand for electronic devices and government initiatives aimed at boosting local manufacturing. However, India’s reliance on imports makes it vulnerable to global supply chain disruptions caused by geopolitical tensions.

- Key Factors Influencing Demand:

- Rising consumer electronics market.

- Growth of electric vehicles (EVs) and renewable energy technologies.

- Government initiatives like the Production Linked Incentive (PLI) scheme.

Impact of Geopolitical Tensions on Semiconductor Prices

China-Taiwan Conflict and Its Implications

The ongoing tensions between China and Taiwan pose significant risks to the global semiconductor supply chain. Any disruption in Taiwan’s production capabilities can lead to shortages and increased prices worldwide. Given that Taiwan supplies a substantial portion of the world’s semiconductors, Indian manufacturers may face higher costs and longer lead times for chip deliveries.

- Potential Outcomes:

- Increased prices due to scarcity of chips.

- Extended lead times affecting production schedules across various industries.

- Shift towards alternative suppliers or increased domestic production efforts.

Price Predictions for Semiconductors in India (2025 Onwards)

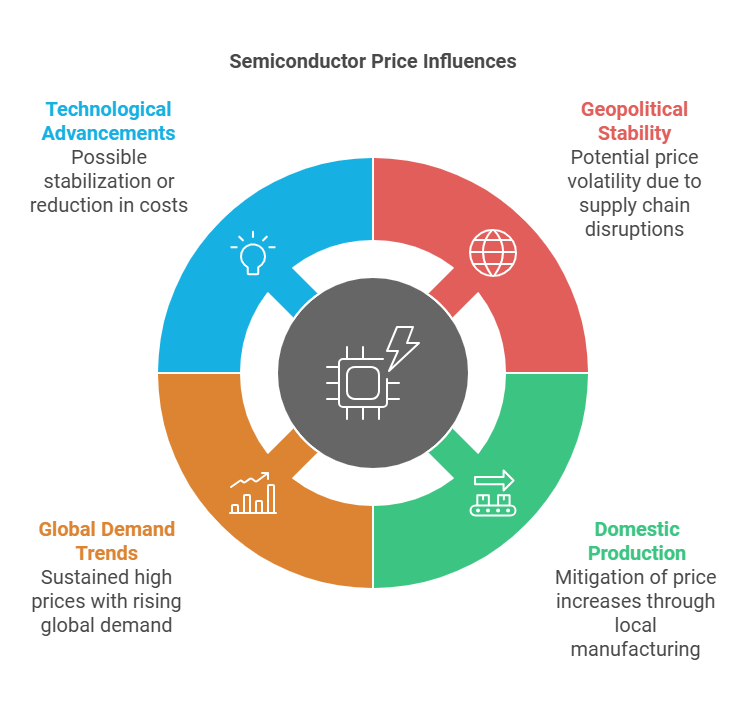

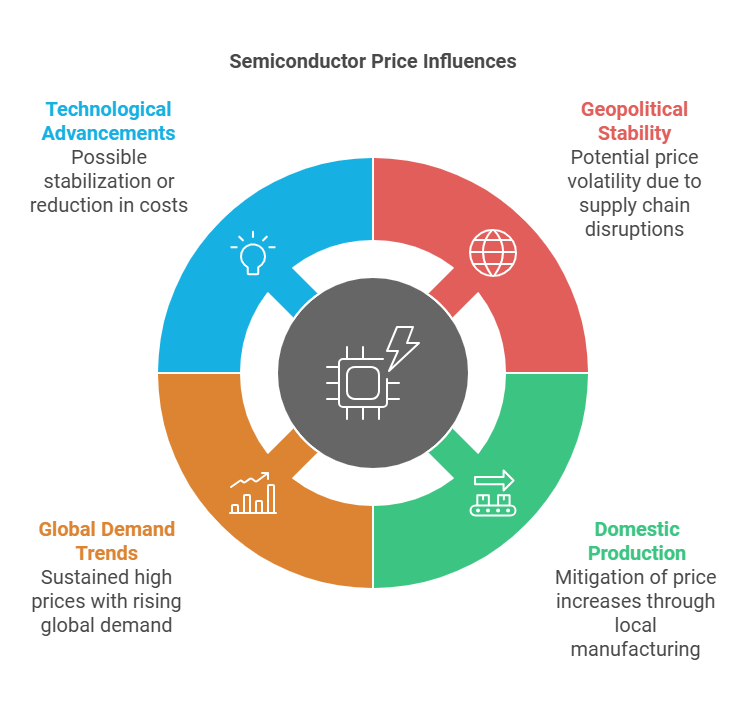

Several factors will influence semiconductor prices in India over the coming years:

Several factors will influence semiconductor prices in India over the coming years:

- Geopolitical Stability: If tensions between China and Taiwan escalate further, continued volatility in semiconductor prices is expected due to supply chain disruptions.

- Domestic Production Initiatives: The success of India’s government initiatives to boost local manufacturing could mitigate some price increases by reducing reliance on imports.

- Global Demand Trends: The overall demand for semiconductors globally will also play a crucial role. If demand continues to rise, especially with the growth of AI and IoT technologies, prices may remain elevated.

- Technological Advancements: Innovations in manufacturing processes could lead to more efficient production methods, potentially stabilizing or lowering costs over time.

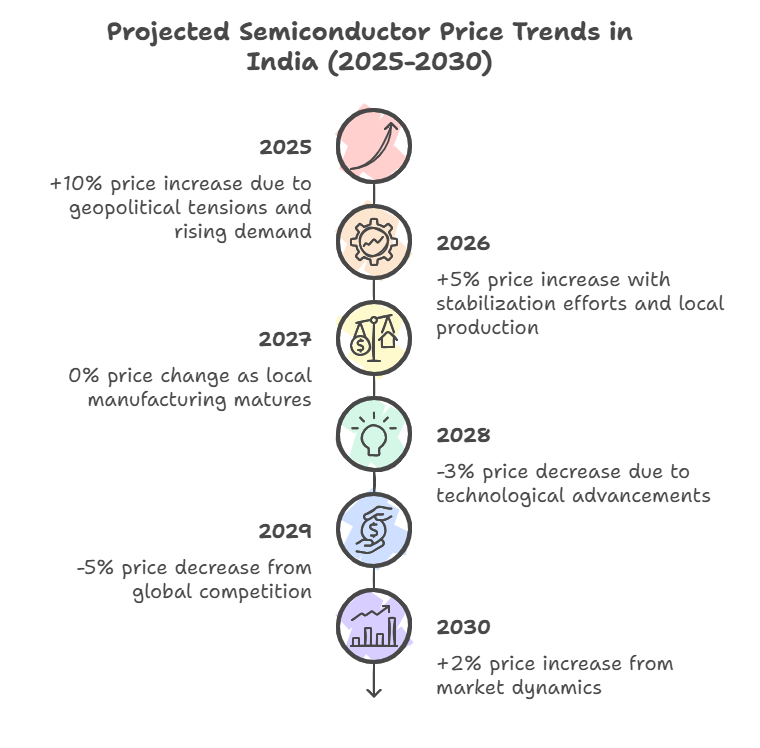

Comparison Table: Projected Semiconductor Prices in India (2025-2030)

| Year | Projected Price Change (%) | Key Influencing Factors |

|---|---|---|

| 2025 | +10% | Continued geopolitical tensions; rising demand |

| 2026 | +5% | Stabilization efforts; increased local production |

| 2027 | 0% | Maturity of local manufacturing initiatives |

| 2028 | -3% | Technological advancements; improved supply chain |

| 2029 | -5% | Increased competition from global players |

| 2030 | +2% | Fluctuations due to market dynamics |

Long-term Implications for India’s Semiconductor Industry

The ongoing conflict between China and Taiwan will likely have long-term implications for India’s semiconductor industry. To enhance self-sufficiency in semiconductor manufacturing, India must navigate these geopolitical challenges carefully while investing strategically in domestic capabilities.

- Strategic Initiatives:

- Strengthening local manufacturing through government support.

- Investing in research and development to foster innovation within the industry.

- Building partnerships with global semiconductor firms to leverage expertise and technology.

Frequently Asked Questions (FAQs) on Semiconductor Prices in India Amidst the China-Taiwan Conflict

1. What is the current state of semiconductor prices in India?

Semiconductor prices in India have been volatile due to global supply chain disruptions and geopolitical tensions, particularly between China and Taiwan. Prices are expected to rise in the short term due to increased demand and supply constraints.

2. How does the China-Taiwan conflict affect semiconductor prices in India?

The conflict poses significant risks to the semiconductor supply chain, as Taiwan is a major supplier of chips. Disruptions in production can lead to shortages and increased prices in India, affecting various sectors reliant on semiconductors.

3. What are the key factors influencing semiconductor prices in India?

Key factors include:

- Geopolitical tensions

- Global demand for electronics

- Domestic manufacturing initiatives

- Supply chain stability

4. Is India self-sufficient in semiconductor production?

Currently, India is not fully self-sufficient in semiconductor production and relies heavily on imports. However, government initiatives like the Production Linked Incentive (PLI) scheme aim to boost local manufacturing capabilities.

5. What role does TSMC play in the global semiconductor market?

Taiwan Semiconductor Manufacturing Company (TSMC) is the largest contract chip manufacturer globally, producing a significant portion of the world’s semiconductors. It plays a crucial role in supplying chips to various industries, including electronics and automotive.

6. How are Indian companies adapting to rising semiconductor prices?

Indian companies are exploring partnerships with global semiconductor firms, investing in local manufacturing, and enhancing supply chain resilience to mitigate the impact of rising prices.

7. What is the forecast for semiconductor prices in India from 2025 onwards?

Prices are expected to fluctuate based on geopolitical stability, domestic production initiatives, and global demand trends. Short-term increases are likely due to ongoing tensions, while long-term strategies may stabilize or reduce costs.

8. Which Indian companies are involved in semiconductor manufacturing?

Companies like Tata Group, Wistron, and others are exploring semiconductor manufacturing opportunities in India, supported by government initiatives aimed at boosting local production.

9. What technological advancements could impact semiconductor pricing?

Innovations in manufacturing processes and materials could lead to more efficient production methods, potentially stabilizing or lowering costs over time.

Conclusion

The changes in semiconductor prices in India from 2025 onwards will be influenced by a complex interplay of geopolitical dynamics, domestic production initiatives, and global demand trends. While immediate price increases are likely due to supply chain vulnerabilities, long-term strategies focused on enhancing local production capabilities could provide some relief. Stakeholders across the industry must remain vigilant and adaptable as they navigate this evolving landscape.