Iran-Israel Conflict: Economic and Geopolitical Impact |Impact on India U.S.A. and Russia

Escalating Conflict of Iran and Israel

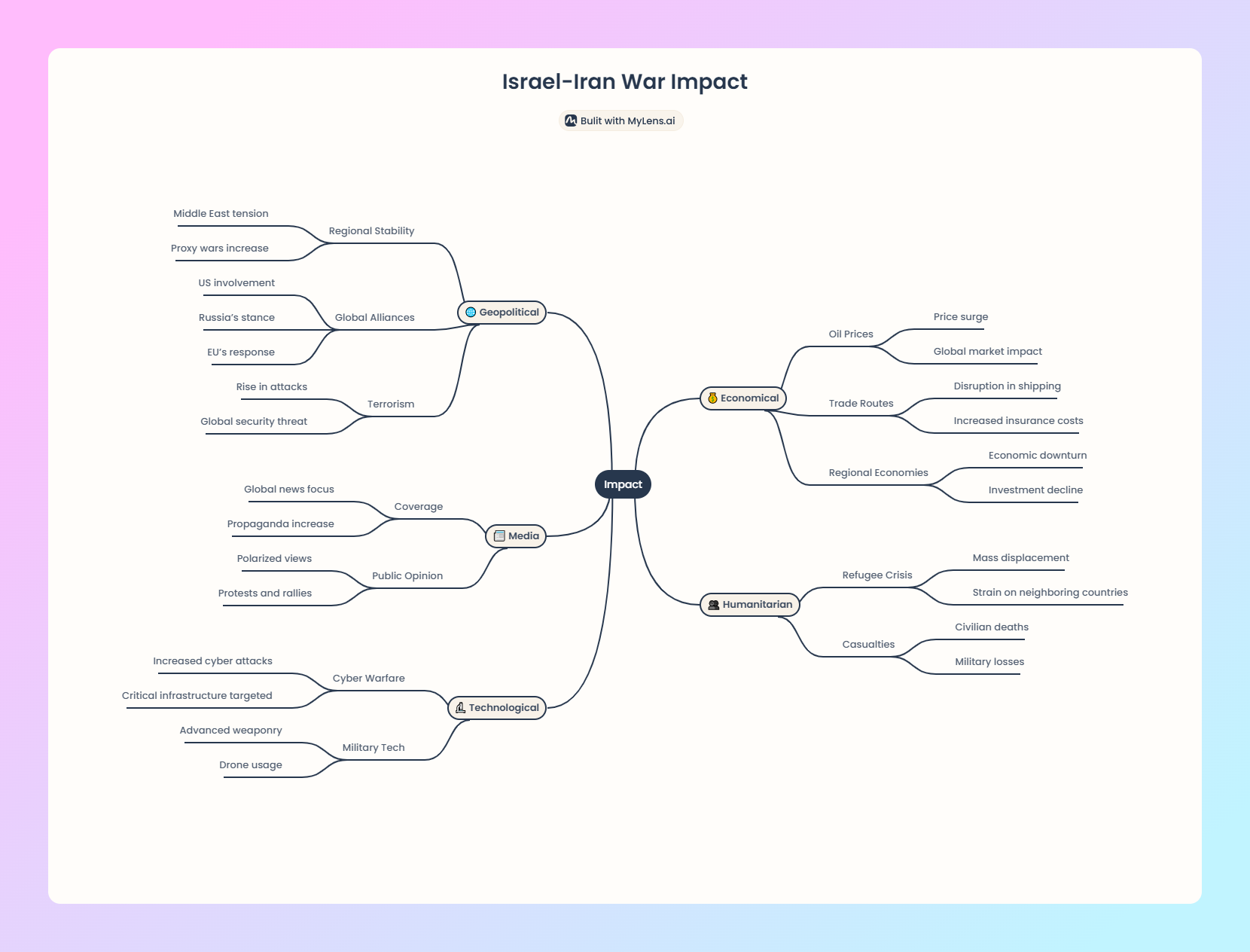

The escalating conflict between Israel and Iran has significant implications for the global economy, particularly through on energy prices, stock markets, and trade routes. Today we will try to understand what could be Economic and Geopolitical Impact |Impact on India U.S.A. and Russia

Table of Contents

- Economical and Geopolitical Impact on Stock Indices of Israel and Iran

The Israel-Iran conflict has had a negative impact on Economically global stock markets, with varying effects depending on market maturity. Developed markets are experiencing less volatility than frontier and standalone markets, which are experiencing the most severe adverse effects, this is the main economic impact of the Iran-Israel war

- Impact on Investor Behavior:

As geopolitical tensions rise, investors are likely to shift their portfolios towards safer assets such as the US dollar and gold, leading to a decline in equity valuations across sectors. The flight to safety is particularly evident in US dollar currency pairs, which have shown positive abnormal returns during this period

- Sector-Specific Impacts of Clnflict of of Israel and Iran

Iran-Israel Conflict Rising crude oil prices and supply chain disruptions could lead to a clear decline in oil-heavily dependent industries such as transportation and manufacturing.

- Crude Oil Prices:

The conflict threatens to disrupt key oil supply routes, particularly through the Strait of Hormuz, where about 20% of the world’s oil passes. This could lead to a significant increase in crude oil prices, potentially exceeding $100 a barrel. Such a rise would add to inflationary pressures globally, impacting economies that are heavily dependent on oil imports.

- Inflationary Pressures:

Higher oil prices can increase the cost of goods and services, strain household budgets, and slow economic growth in many countries. For example, India’s projected oil import bill could increase substantially due to these developments..

Trade Disruptions During Israel and Iran Conflict

- Shipping Routes:

The conflict of Israel and Iran has raised concerns about access to vital shipping routes such as the Red Sea, which could increase freight costs and put further pressure on global supply chains.

- Global Trade Volatility:

Trade disruptions caused by increased military activity could lead to a reevaluation of trade agreements and partnerships, particularly for countries closely tied to Israel or Iran.

Regional Economic Impacts of this Conflict

- Israel’s Economic Strain:

Israel’s economy is already under significant pressure due to increased military expenditures and a rising budget deficit projected at 8% of GDP. Economic growth forecasts have been downgraded from an expected 3.4% to between 1% and 1.9% as the conflict continues4.

- Implications for India:

India’s economy is particularly vulnerable due to its dependence on oil imports from the Middle East. The ongoing conflict could disrupt trade flows and raise inflation, complicating monetary policy decisions for the Reserve Bank of India

- Long-term Outlook:

India’s economy is particularly vulnerable due to its dependence on oil imports from the Middle East. The ongoing conflict could disrupt trade flows and raise inflation, complicating monetary policy decisions for the Reserve Bank of India

Iran-Israel Conflict: Economic and Geopolitical Impact |Impact on India U.S.A.and Russia

Impact on India

- Economic Issue:- India is highly dependent on oil imports, with around 85% of its crude oil sourced from the Middle East. The conflict has already led to rising oil prices, which could significantly impact India’s economy by increasing inflation and widening the current account deficit. A sustained increase in oil prices could add approximately 0.3% to India’s current account deficit for every $10 rise in crude prices.

- Trade Disruptions:- Key shipping routes like the Strait of Hormuz are vital for Indian trade. Any conflict escalation could disrupt these routes, leading to increased shipping costs and delays that would affect various sectors, including textiles and engineering.

- Expatriate Concerns:- With millions of Indians working in the Gulf region, any escalation in conflict poses risks to their safety and employment, potentially reducing remittance inflows that are crucial for the Indian economy

Strategic Considerations

India’s diplomatic balancing act between Israel and Iran may become increasingly complex as it seeks to protect its economic interests while promoting regional stability. The U.S.’s strong support for Israel complicates India’s position, particularly as it navigates its energy security needs amid rising tensions in the region.

Impact on Russia

- Energy Security:-Oil Supply Dynamics, Russia’s role as a significant oil supplier could be affected by disruptions in Middle Eastern oil supplies due to the conflict. If Iran’s ability to export oil is compromised or if Israel targets Iranian oil facilities, global oil prices could surge, benefiting Russian revenues but also increasing competition from other suppliers like Saudi Arabia

- Geopolitical Positioning:- The conflict may shift Russia’s strategic calculations in the Middle East. As a key player in energy markets, Russia might seek to strengthen ties with countries impacted by the conflict or those looking for alternatives to Middle Eastern oil dependency

- Military and Diplomatic Maneuvering:-Russia’s historical ties with Iran may lead it to adopt a more supportive stance towards Tehran, especially as it seeks to counterbalance U.S. influence in the region. However, Russia must also consider its relationships with Israel and other regional players when formulating its response

Impact on the United States

- Increased Tensions: The U.S. has reaffirmed its commitment to Israel, leading to fears of direct military confrontation with Iran as tensions escalate. The U.S. has already faced over 150 attacks on its forces in Iraq and Syria from Iran-backed groups amid this conflict. This situation raises concerns about a broader regional war that could involve U.S. military assets stationed nearby.

- Strategic Restraint: Despite strong support for Israel, the U.S. aims to avoid a larger military escalation that could destabilize the region further. Washington is reportedly encouraging Israel to calibrate its responses carefully to prevent triggering a wider conflict involving Iranian allies across the Middle East

- Economic Considerations: The U.S.’s focus on supporting Israel while managing its own economic interests complicates its foreign policy approach. Rising global oil prices due to conflict-related disruptions could affect U.S. inflation rates and economic recovery efforts post-pandemic

- Conclusion

In summary, the Israel-Iran conflict poses substantial risks to the global economy through its potential to destabilize stock markets, drive up energy prices, disrupt trade routes, and create inflationary pressures that could hinder economic growth worldwide.

Image Source:mylense.ai

Post Comment