What is UPI Circle, for Minors in India: A Complete, Easy Guide for Parents and Teens

If your child keeps asking for money to recharge their phone, buy snacks at the canteen, or pay for coaching classes, you no longer need to hand over cash or share your UPI PIN. UPI Circle lets you safely give your child controlled UPI access from your own bank account. Think of it as a supervised allowance, right inside your UPI app. NPCI

Below is a simple, practical guide that covers what UPI Circle is, who can use it, the limits, how to set it up on popular apps, safety tips, and answers to common questions. We also link to official circulars and app guides so you can double-check everything.

Table of Contents

What is UPI Circle

UPI Circle is a feature where a primary user (usually a parent) authorizes a secondary user (like a child) to make UPI payments from the primary user’s bank account. You choose how much control to give: approve every payment yourself (partial delegation) or allow your child to pay on their own within monthly and per-transaction limits (full delegation). NPCI

NPCI introduced UPI Circle in August 2024 and added extra rules in July 2025 to make full delegation safer and more compliant. NPCI+1

Why UPI Circle is useful for minors

- No separate bank account needed for the child. A teen can pay using your account with your permission and limits. NPCI

- You stay in control. You can require your approval for each payment or set spend limits. You also see all transactions. NPCI

- Safer than sharing your PIN. The child never needs your UPI PIN. Apps must use passcode or biometrics for the secondary user. NPCI

For context, UPI is now processing over 19.47 billion transactions per month and keeps hitting new records, so features that make payments safer for families matter. NPCIThe Economic Times

Who can use it

- Primary user: Any UPI user with a bank account on a supported app.

- Secondary user: A trusted person such as a child, parent, spouse, sibling, or a helper you trust. For minors, the parent typically acts as the primary user and the child as the secondary user. NPCI

Note on minors’ own accounts: RBI allows minors above 10 to operate savings accounts independently (with bank-set limits). That is separate from UPI Circle. With UPI Circle, a minor can transact from a parent’s account under controls even without holding their own bank account. Reserve Bank of India

Limits you should know

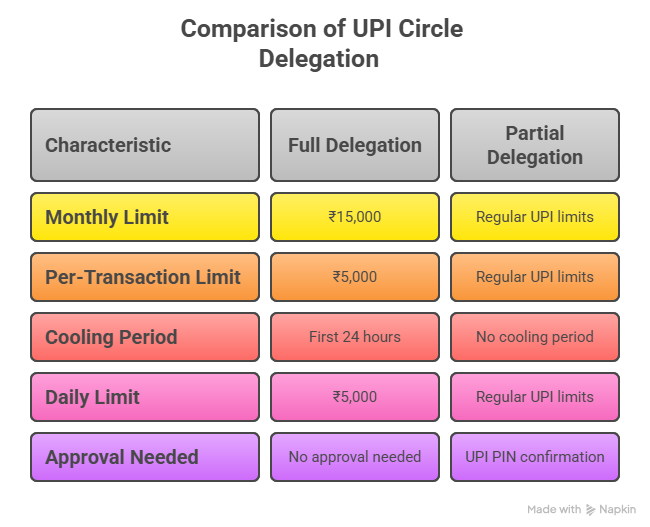

NPCI’s circular sets clear caps to reduce risk:

- Full delegation (child can complete payments within limits):

- Maximum monthly limit per delegated user: ₹15,000

- Maximum per-transaction limit: ₹5,000 NPCI

- Cooling period after linking (first 24 hours):

- Daily limit capped at ₹5,000 for both partial and full delegation. NPCI

- Partial delegation (you approve every payment):

- Regular UPI limits apply; you still confirm using your UPI PIN. NPCI

Apps and banks must also give you usage controls and clear visibility of all transactions done by the secondary user. NPCI

What KYC details are needed for the child

For full delegation, the bank and the app must identify the secondary user using an Officially Valid Document as defined in RBI’s KYC Master Direction (for example, Aadhaar, etc., as applicable). The secondary user must also give explicit consent to share document type and number. NPCI

Which apps support UPI Circle today

- BHIM has rolled out UPI Circle with partial delegation and controls. BHIM UPI

- Google Pay supports UPI Circle and explains how primary and secondary users work. Google Pay also has a dedicated flow for users aged 13–18 with guardian permission. Google Help+1

- PhonePe went live with UPI Circle in April 2025. PhonePe

Many quick explainers also show real-life use for children and family members. Always rely on your app’s in-app instructions or help center for the latest steps. Forbes India

Step-by-step: Set up UPI Circle for your child

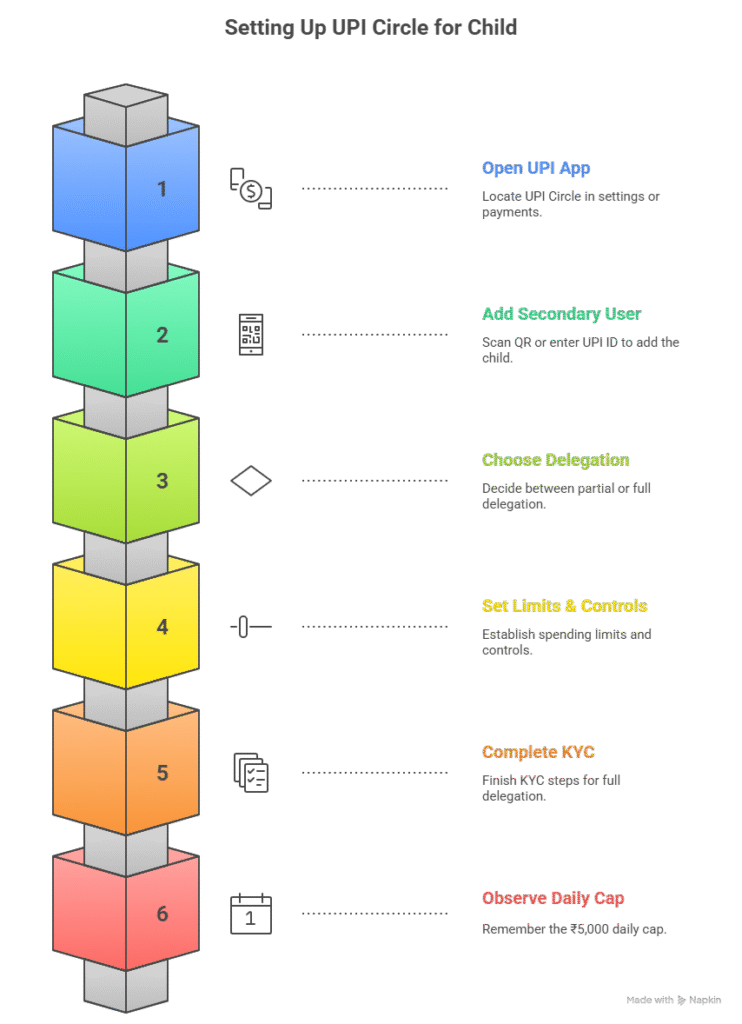

The exact screens vary by app, but the flow is similar:

- Open your UPI app and find UPI Circle in settings or payments features.

- Add a secondary user by scanning their QR or entering their UPI ID, then select their contact from your phonebook. Manual number entry is restricted to prevent mistakes. NPCI

- Choose partial or full delegation.

- Partial: your child requests; you approve with your PIN.

- Full: your child pays directly within set limits. NPCI

- Set limits and controls for the child. Apps must provide limit controls for the primary user. NPCI

- For full delegation, complete KYC steps the app asks for and take the child’s consent to share their ID details. NPCI

- During the first 24 hours, remember the ₹5,000 daily cap. NPCI

Helpful app guides: Google Pay’s step-through on UPI Circle and teen accounts, and PhonePe’s launch note with setup info. Google Help+1PhonePe

Everyday examples for families

- Daily allowance: Set a monthly cap of ₹15,000 with a per-payment cap of ₹5,000. Your teen can pay for snacks, rides, books, and classes without asking you each time. NPCI

- Approval for big spends: Keep partial delegation on for online shopping. Your teen can initiate the payment; you approve with your UPI PIN. NPCI

- Shared errands: Teens can pay for groceries or fuel and you can track everything in your bank statement and app history. NPCI

Safety checklist for parents

- Never share your UPI PIN. With partial delegation, only you enter it. NPCI

- Use strong screen lock or biometrics on both devices. Apps must enforce app passcodes or biometrics for secondary users. NPCI

- Start with partial delegation, observe spending patterns, then switch to full delegation if needed.

- Review transactions weekly. Apps must give you visibility of what the child paid. NPCI

- Teach scam awareness. Remind your child to pay only verified merchants or known contacts. New UPI rules also keep improving fraud checks and transparency of payee identity. The Economic Times

Frequently asked questions

Q1. Does my child need a bank account?

No. With UPI Circle, a child can be a secondary user on your account with limits and your approval settings. NPCI

Q2. What is the maximum my child can spend?

If you choose full delegation, the system caps it at ₹15,000 per month and ₹5,000 per transaction, set by NPCI. During the first 24 hours after linking, there’s a ₹5,000 daily cap. Apps may also let you set lower limits. NPCI

Q3. Can I add many children?

A primary user can delegate to up to five secondary users. Each secondary user can accept delegation from only one primary user. NPCI

Q4. How do I stop access if a phone is lost?

Open your UPI app, remove the secondary user from your Circle, and ask your bank to block if needed. Apps must support dispute and reversal as per existing UPI rules. NPCI

Q5. Is this legal for minors?

Yes. RBI already permits minors above 10 to operate bank accounts with bank-set limits. UPI Circle is an NPCI framework that lets you delegate payments safely from your own account, with KYC and consent rules for full delegation. Reserve Bank of IndiaNPCI+1

Where UPI Circle fits in India’s payments story

UPI keeps breaking records and is now a daily habit across India. In July 2025, UPI processed 19.47 billion transactions worth ₹25.08 lakh crore. Delegated features like UPI Circle make that growth safer and more inclusive for families with teens, elders, and dependents. NPCI

Want more money tips for families

- Explore practical guides and money tips on our blog: https://www.letusinsure.com/blog/

- Need help choosing the right family insurance or planning a budget with teen expenses: https://letsinsure.in/financial-services/

- Read more about us: https://letsinsure.in/about/

- Ask us anything or book a quick chat: https://letsinsure.in/contact-us/

- Plan together using free financial calculators: https://letsinsure.in/financial-calculators/

Key sources you can trust

- NPCI’s UPI Circle product overview and official circulars introducing UPI Circle and setting limits, controls, and KYC rules. NPCI+3NPCI+3NPCI+3

- BHIM, Google Pay, and PhonePe pages confirming app support and setup flows. BHIM UPIGoogle Help+1PhonePe

- RBI note on minors operating bank accounts. Reserve Bank of India

- Latest UPI usage data to show scale and relevance. NPCI